Case Studies

Revolutionize your banking services beyond branches with our agency banking solution

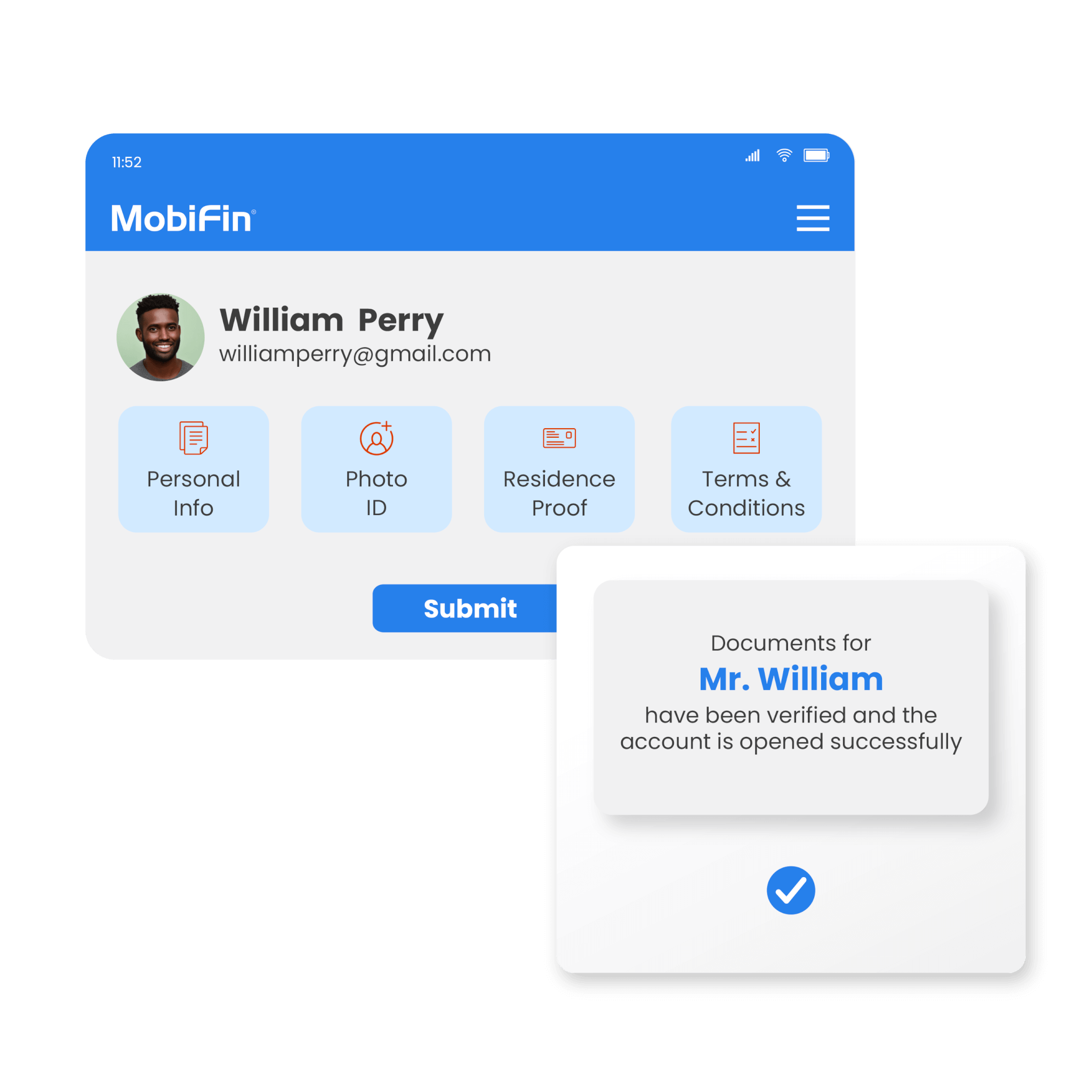

Digital onboarding (self and assisted)

Streamline customer onboarding with AI-enabled and configurable workflow.The platform streamlines customer onboarding with AI-enabled and configurable workflows. Agents input customer data, validate documents, ensure compliance, and initiate real-time account openings while maintaining security. The platform handles updates, balances, and compliance. The easy-to-access interface, verification checks, and integration streamline the process, contributing to financial inclusion and regulatory adherence.

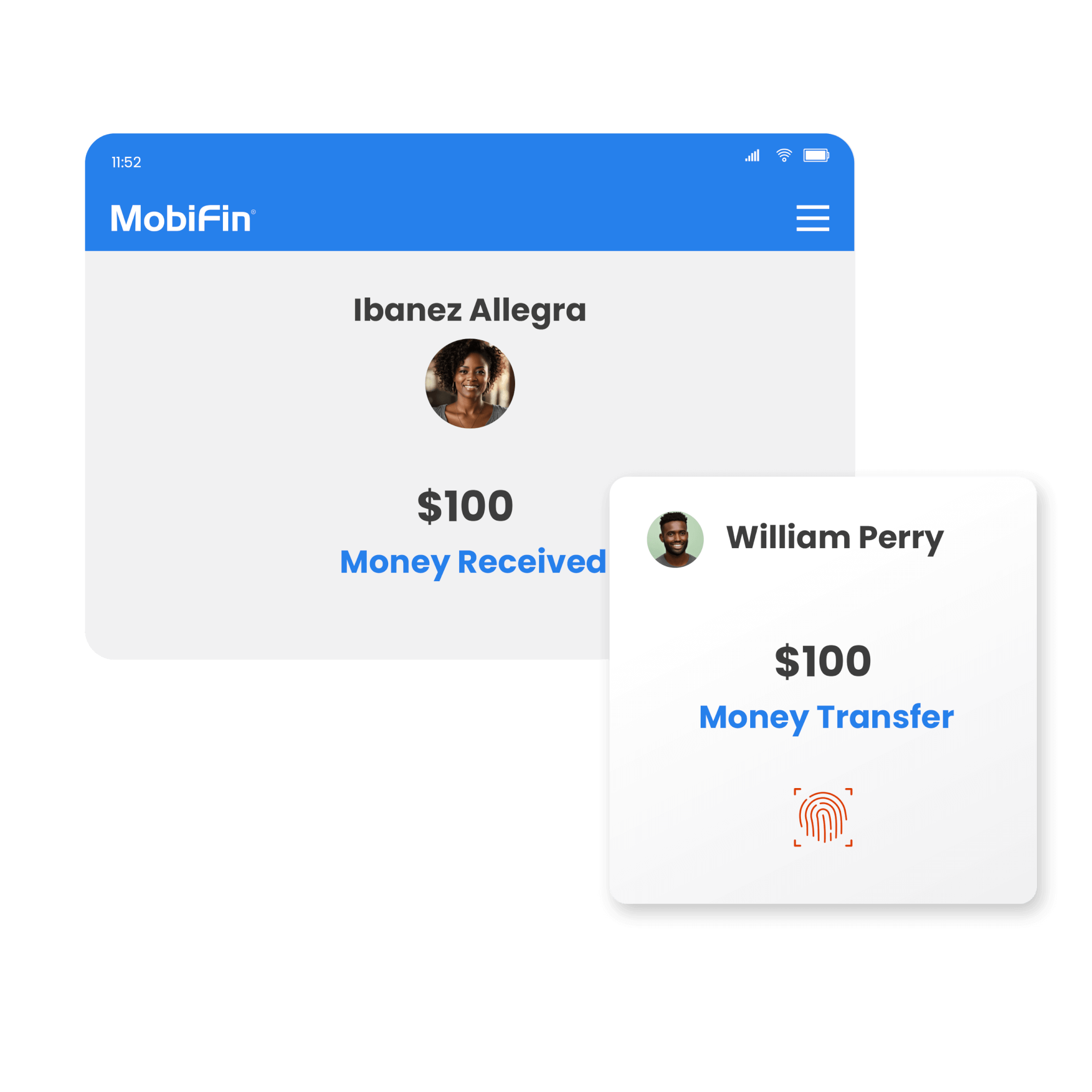

Fund transfers

Making seamless movement of funds between accounts easy. Agents can initiate transfers, perform real-time transactions, select source and destination accounts, and set transfer amounts with the consent of customers. The platform ensures security, integrates with backend systems, and offers transaction records, enhancing financial accessibility and control.

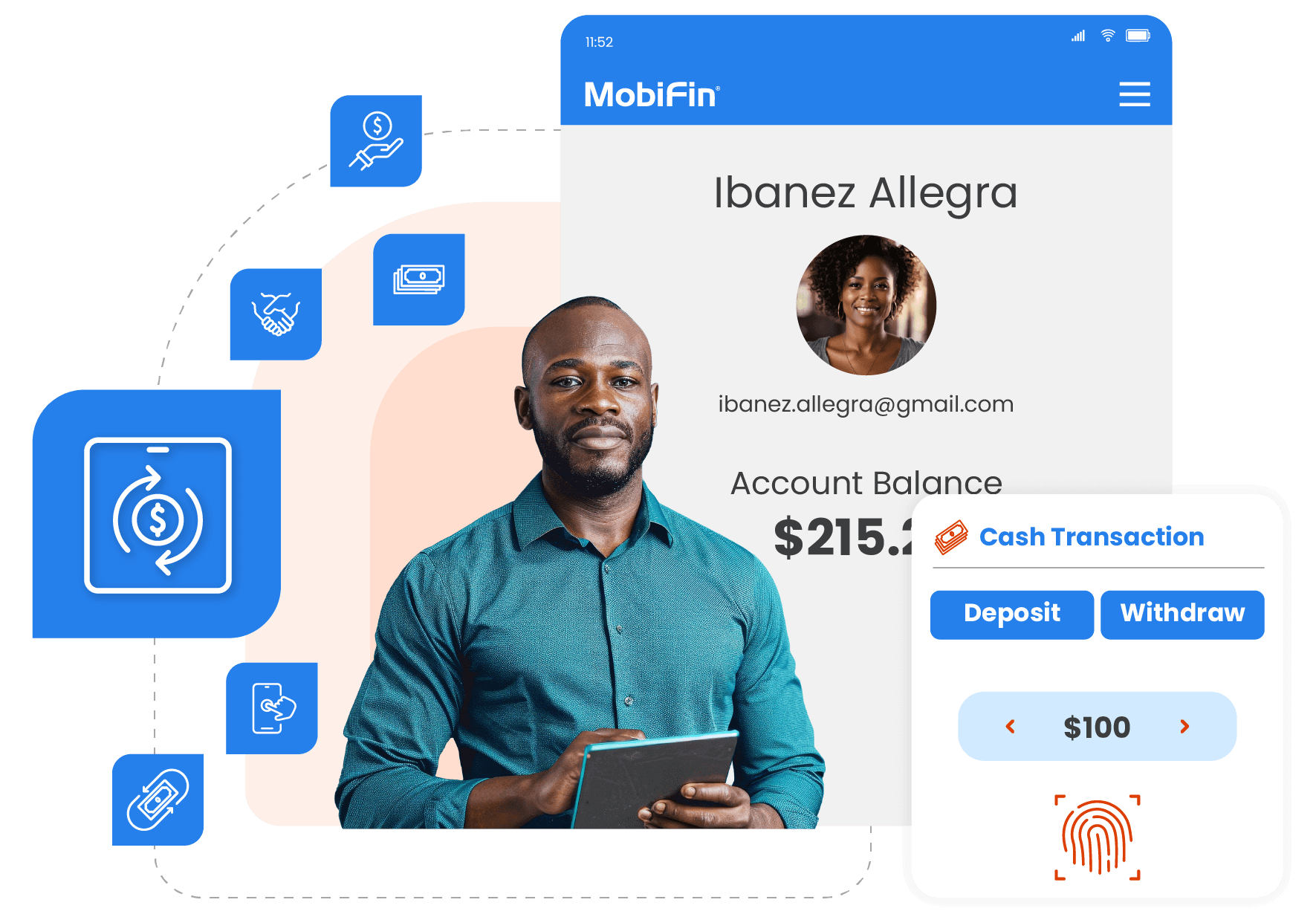

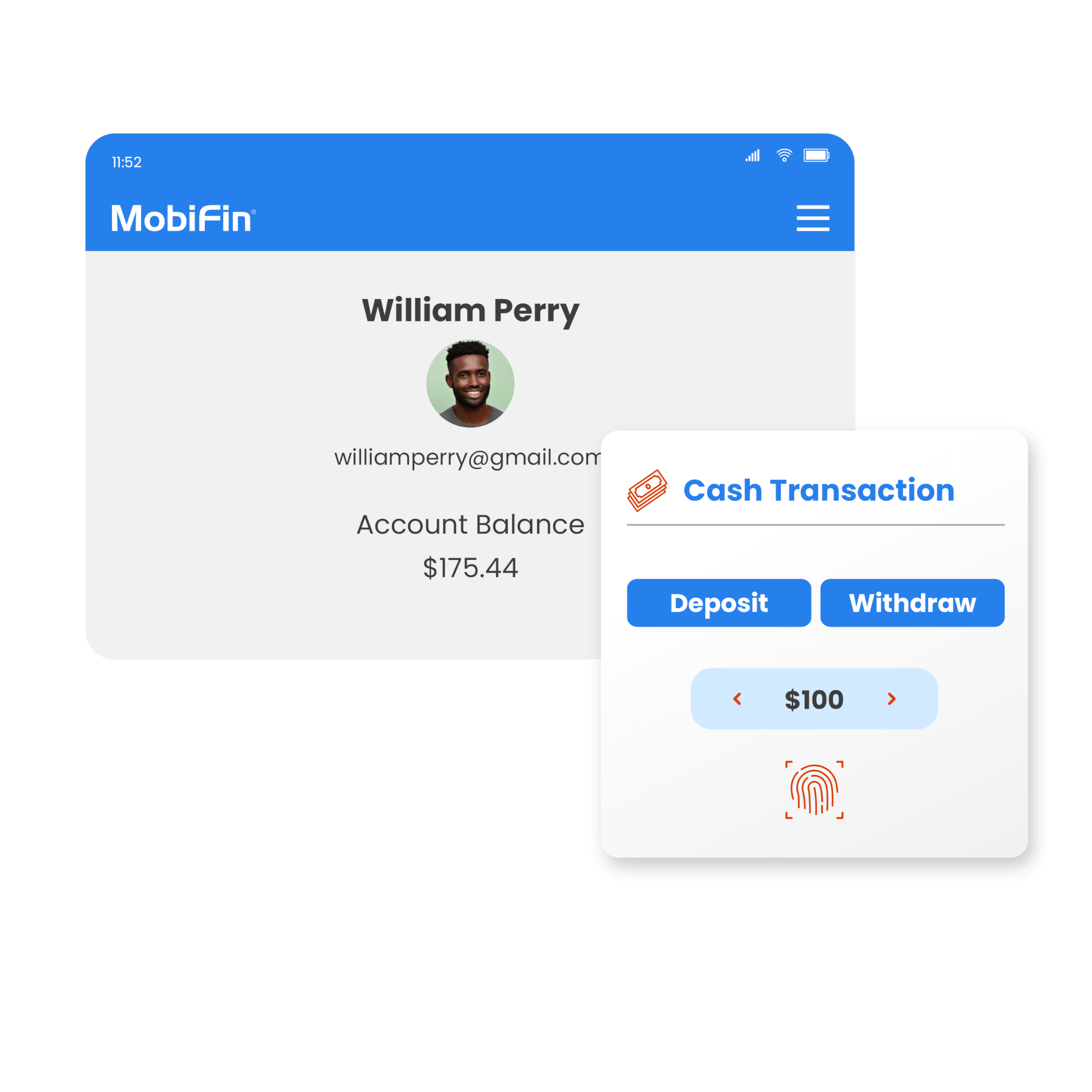

Cash deposits and withdrawals

MobiFin empowers agents to handle in-person transactions on behalf of customers. Agents can accept cash deposits, update account balances in real time, and process withdrawals securely. Moreover, this feature aligns with customers' savings goals. By enabling easy access to their accounts, it promotes a culture of financial prudence and empowers individuals to achieve their savings objectives.

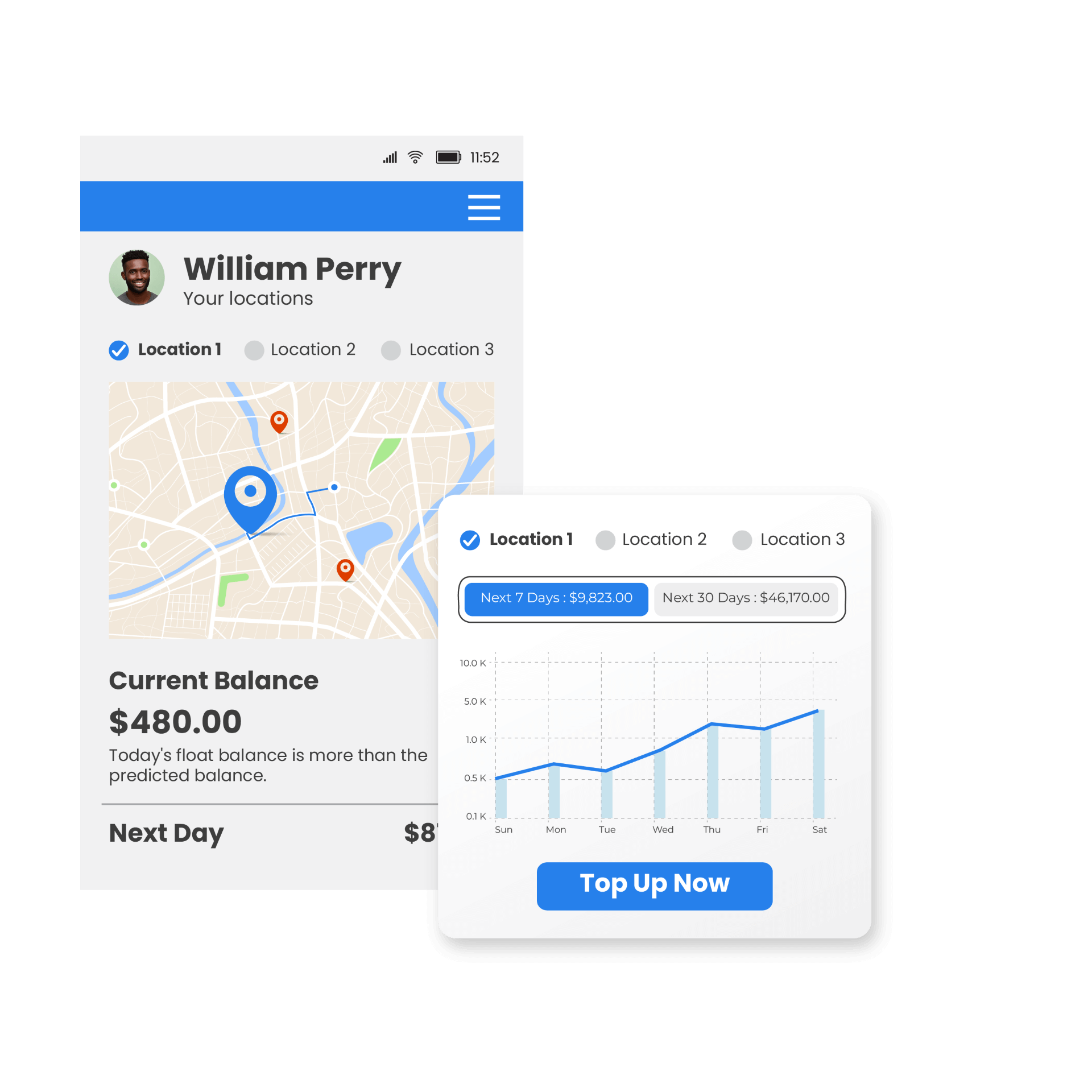

AI-enabled liquidity prediction

Unplanned cash flow management leads to insufficient funds to meet customer demands at agent locations. Therefore, agents must balance account/float and cash, considering upcoming daily, weekly, and monthly requirements. AI-enabled predictions lead to reduced cash shortage and prevention of declined transactions. This results in higher revenue, increased customer satisfaction, and creating strong brand loyalty.

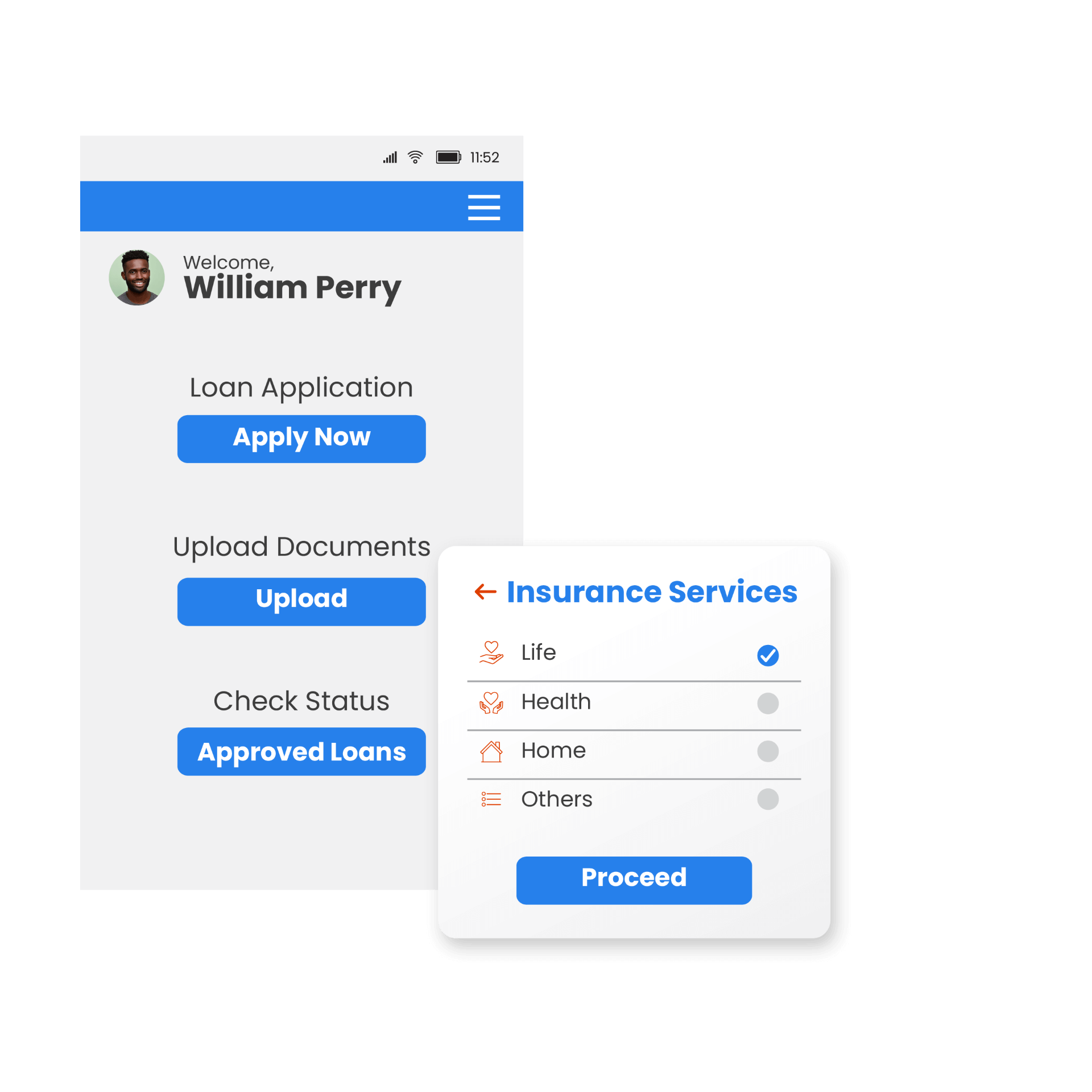

Loans and insurance

The platform enables agents to guide clients through loan applications, ensuring fast submissions and lending. Moreover, agents facilitate seamless loan repayment processes, accepting payments and updating loan accounts promptly. MobiFin also integrates with third parties to offer insurance services. Whether it is life, health, property, or others, its framework enables seamless purchase and renewal of insurance schemes.

Frequently asked questions

Agent float management and its real time settlement will be primarily handled within the MobiFin Agency Banking (E-money) system, ensuring efficient and secure control over agent funds.

Yes, our platform fully supports agent onboarding, agent hierarchy management, and a diverse range of financial and non-financial services as listed in the next FAQ answer.

MobiFin offers a range of banking services, including

- Bank deposits and withdrawals

- Top-up, Bill and loan repayments

- Electronic fund transfers

- Account balance inquiries

- KYC and other document collection on behalf of service provider

- Agent assisted customer onboarding

Yes, as a white labelled platform we offer a high degree of flexibility, allowing you to tailor the look and feel, branding elements, and user-friendly interface to align seamlessly with your existing brand identity.

Our platform offers flexible capabilities for managing fees, revenue, and limit policies, which includes the ability to configure real-time or deferred weekly/ monthly commission payouts.

MobiFin employs robust security measures to protect agency banking transactions. These include strong user authentication, role-based access control, data encryption at rest and in transit, and adherence to industry security standards

Yes, our platform offers flexible integration capabilities that allow for seamless integration with various third-party services, including banking ecosystems, top-up providers, and bill payment systems within your system and infrastructure.

MobiFin’s flexible, modular, and scalable micro-service architecture ensures high availability, performance, and scalability to handle your growing business needs.

MobiFin offers a comprehensive suite of reporting and analytics tools, that are easily accessible through mobile application. These provides valuable insights into your agents’ activities and performance.

Our agency banking platform ensures compliance with international regulatory requirements such as ISO 27001 and NIST. In addition, we are also able to comply with regional and local regulatory requirements. For example, CRDB Bank Plc, an African bank and the leading financial services provider in Tanzania, uses our agency banking platform, which meets all local regulatory requirements.