This piece will unveil the significance of a core banking solution being appropriately chosen and also bring to light five major mistakes that, in most cases, are made during the selection process.

Through insights into these pitfalls and preventing possible measures, banks and financial institutions can begin a journey of increased profitability, satisfied customers, and sustainable growth.

The Five Pillars of Core Banking Solution

The basics of a banking system resistant to outside influences require five supporting pillars: the basis for its function and sustainability.

These five pillars are fundamental to banks and other financial institutions that aim to use core banking technology to facilitate processes, improve client experiences, and drive growth.

Let’s go through the pillars and their importance within a core banking infrastructure system:

1. Account Management

Right in the center of the core banking solution is account management, which has to be very powerful.

This pillar comes into sight through functionalities connected with the opening, maintaining, and managing of customer accounts in many products, such as savings accounts, current accounts, term deposits, and loan accounts.

Banks rarely manage their accounts efficiently, which allows them to open customer accounts without any hiccup, to process transactions accurately and timely, and to provide customer support rapidly.

Thus, the foundation of close relationships between banks and their customers is based on high satisfaction.

2. Transaction Processing

Transaction processing represents the cornerstone of the core banking operations that offer fast and easy execution of the financial transactions between customers, counterparties, and financial organizations.

The last pillar provides the means to realize actions like payment processing, fund transfers, settling, and reconciliation.

A high-grade financial transaction processing system providing for effective and secure movement of funds, concurrent real-time transaction tracking, and improved bank operation efficiency serves as a platform for meeting the growing customer expectations of speed, reliability, and transparency.

3. Risk Management and Compliance

In today’s world of complicated regulatory matters, competent risk management and monitoring are of primary importance for institutions to ensure their assets are secure, their operations are within regulations, and the corporate risks are reduced.

One of the operation’s pillars includes risk assessment, regulatory compliance, anti-money laundering (AML), and fraud detection functions.

By establishing strict risk management and compliance systems, banks can identify, eliminate, and prevent incurring these risks, maintaining compliance with regulatory requirements and anti-financial crime efforts, enabling them to keep a good reputation and confidence of the customers and stakeholders.

4. Customer Relationship Management (CRM)

Customer care, manifested in developing and maintaining excellent client relationships, is the most critical aspect of any financial institution.

The CRM pillar covers tools for determining the customers’ needs, habits, and perceptions, and for the output, it expected customer differentiation in service provision, products, and experience.

Using customer data analytics, segmentation, and marketing automation tools, banks can create deeper engagement, better cross-selling opportunities, and increase long-term loyalty and commitment from customers, thus maximizing lifetime value and profitability.

5. Channel Integration and Omnichannel Banking

The modern digital age has customers exclusively conceiving of using banking services through multiple channels such as online banking, mobile banking, branch banking, and self-service kiosks. The integration of channels and omnichannel banking pillar includes functions that give clients consistency, harmony, and personalized habits across all touchpoints and channels. By connecting the individual channels, data, and systems into a singular ecosystem, banks can achieve smooth cross-channel transactions, real-time information flows, and a fluid banking experience aligned with the fast-moving advancement of today’s digitally intelligent customers.

These pillars have been designed to combine operational efficiency, customer experience, and long-term success and achievement for banks and other financial institutions in the ever-competitive and dynamic marketplace.

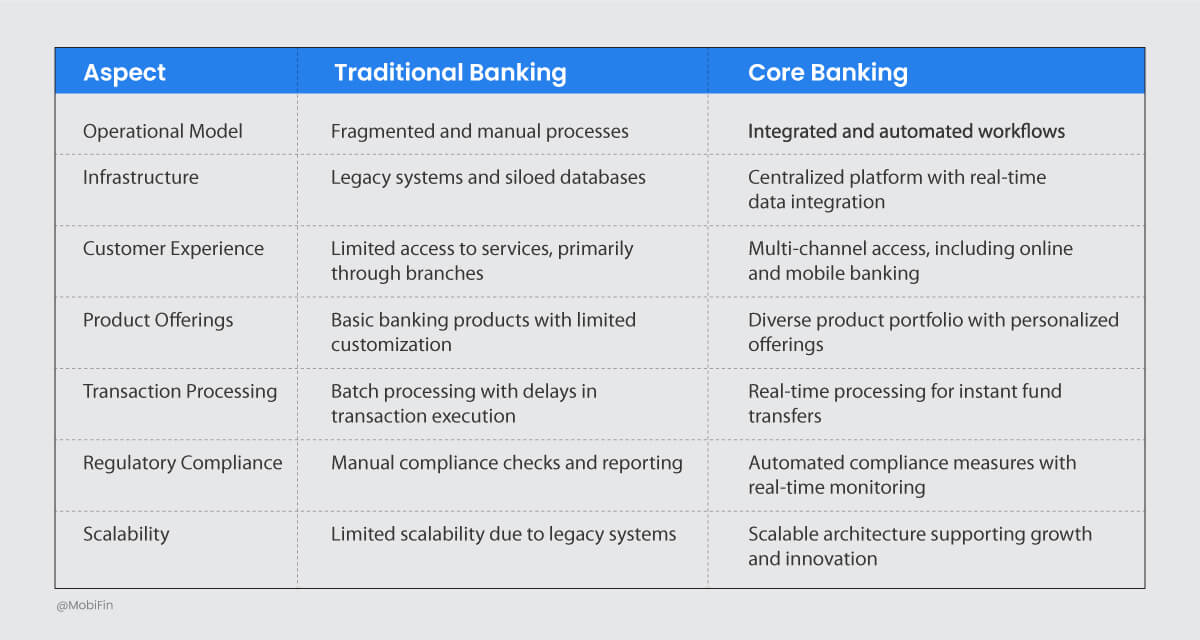

Banking vs. Core Banking

Five Mistakes to Avoid in Core Banking Selection

Let’s address the elephant in the room. Here are the five common mistakes you can avoid while selecting the most suitable core banking partner for your organization.

Mistake 1: Lack of Comprehensive Research

Properly weighing these core banking solutions and providers may leave the institution with a resolution that must adequately respond to its needs.

Banks must carefully assess the complexities of the solutions involved and examine the unique features, functionalities, or vendor capabilities crucial for their operations to ensure they get everything essential.

Solution

Perform comprehensive research on the available core banking and supplier options. Review them by their characteristics, usefulness, scalability, flexibility, brand, and the reviews of their purchasers.

Talk to vendors, request demos, and get feedback from people in the same industry as theirs. Align the chosen solution with the institution’s strategic goals and operational requirements.

Mistake 2: Ignoring Scalability and Flexibility

Shunning scalability and flexibility might lead you to a core banking solution that requires more work to concord with the institution’s future growth and emerging needs.

Systems with no scalability, operational bottlenecks, systems limitations, and increased costs are apparent when the institution expands or introduces new products or services.

Solution

In the early adoption of core banking programs, paying much attention to scalability and flexibility when conducting the assessment is essential.

Examine the solution’s capability to cater to increasing transaction volumes, avail new products, and integrate with the latest technologies.

Opt for a technology that exhibits modular design, cloud capability, and inherent capacity to scale, which can flexibly grow as future needs arise.

Mistake 3: Overlooking Integration Capabilities

The absence of significant integration functionalities may lead to compatibility problems and data silos, consequently forming a barrier to the smooth data flow.

The most crucial component of a core banking solution is its integration abilities. That can improve the existing processes, eliminate data inconsistencies, and produce the desired customer interaction.

Solution

Ensure you go through all the integration features of the core banking system. Make it adaptable to existing systems, other software, emerging technologies, and platforms.

Use the solution with open APIs, pre-built integrations, and flexible mechanisms for data exchange that can easily be integrated into the institution’s existing complex systems.

Mistake 4: Failing to Consider Regulatory Compliance

The reluctance in this area can lead to compliance risk, penalties, and reputational damage for the Bank.

A sound core banking solution with the features needed to manage regulatory compliance requirements may lead to non-compliance with international and local regulations, including data protection, AML, KYC, and reporting obligations.

Solution

The primary focus should be regulatory compliance when selecting a core banking solution. Ensure the solution follows the regulations and standards, e.g., financial regulation or data privacy laws. It should also meet best industry practices.

Choose a solution that gives you compliance functionality and auto-reporting capabilities and supports regulatory changes with regular updates.

Mistake 5: Disregarding Customer Experience and User Interface

Disregarding customer experience and user interface design can result in poor adoption rates, low customer satisfaction, and increased churn.

Institutions can lose customers in cases where the user interface of the core banking solution could be more straightforward and more complex. As such, users become frustrated and disappointed, hence withdrawing from the institution’s services.

Solution

They favored users and prioritized banking interface design in the core banking selection process. Focus on a solution that adds user-friendly interfaces, simplified workflows, and personalized experiences that allow users to share with customers.

Run usability tests, communicate with users, and improve your interface design to ensure that it matches the preferences and needs of the customers.

Navigating Forward: Choose MobiFin as your Core Banking Solution Partner

As you embark on your journey to select the ideal core banking solution provider for your institution, remember that MobiFin can be your guiding light. With its comprehensive features, robust scalability, seamless integration capabilities, regulatory compliance, and customer-centric approach, MobiFin empowers banks and financial institutions to unlock new possibilities and confidently achieve their strategic objectives.

Make the right choice today and embark on a transformative journey with MobiFin as your trusted partner in core banking excellence.