Case Studies

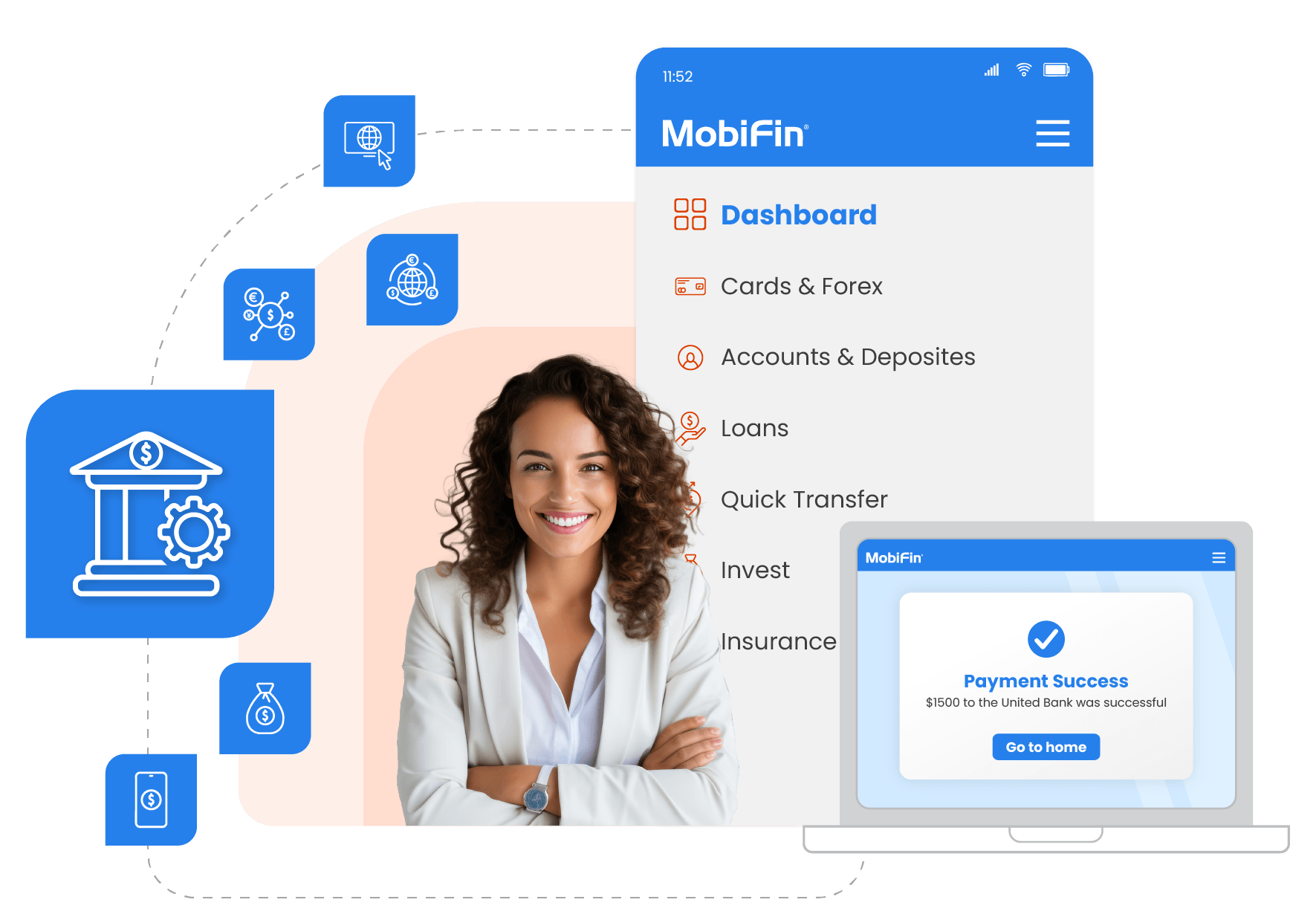

Elevate your customer experience with our core banking solution

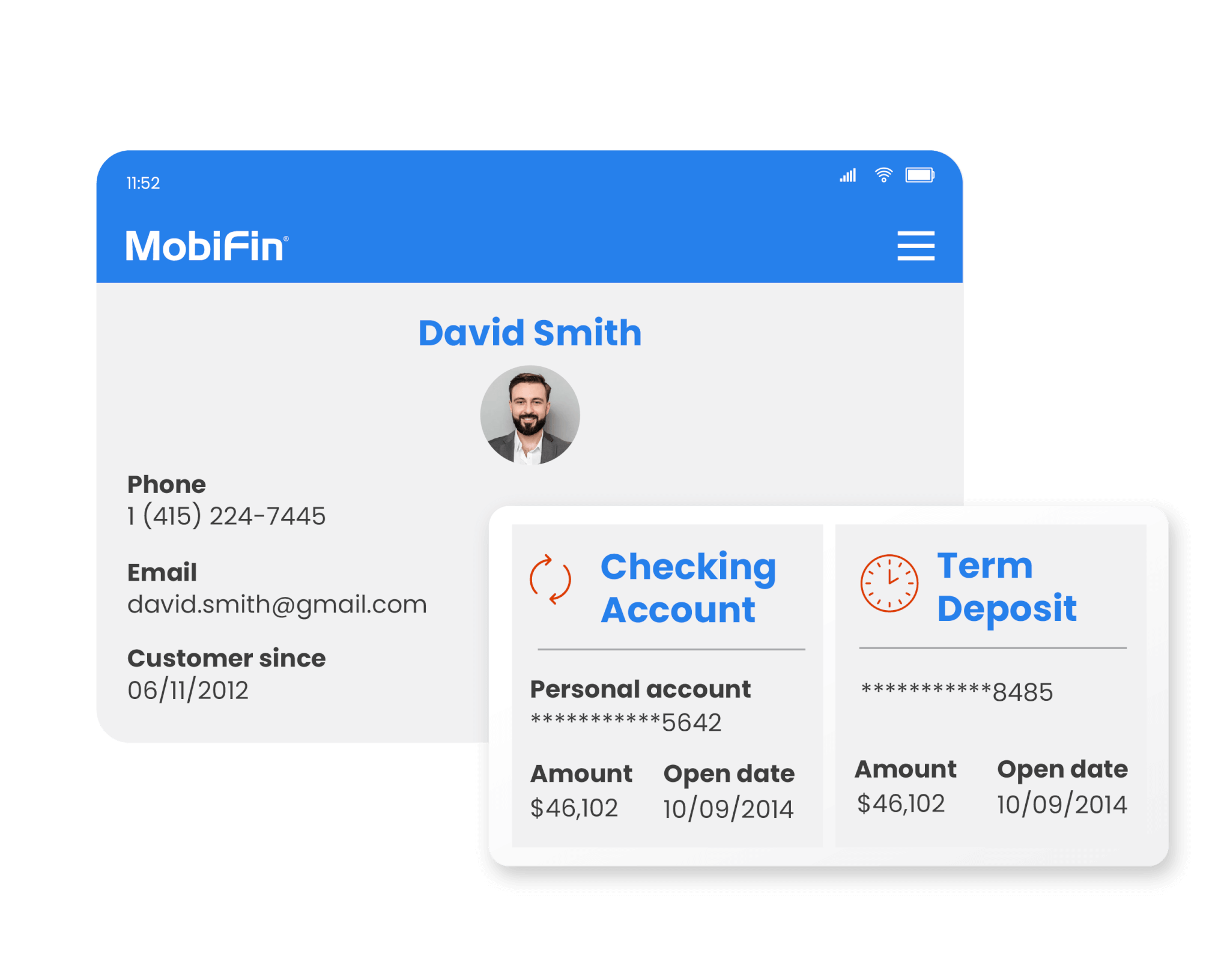

CASA and term deposit

Efficiently manage customer Current and Savings Accounts (CASA) and term deposits, ensuring interest accrual, withdrawals, and renewals. Offer competitive interest rates to attract and retain customers.

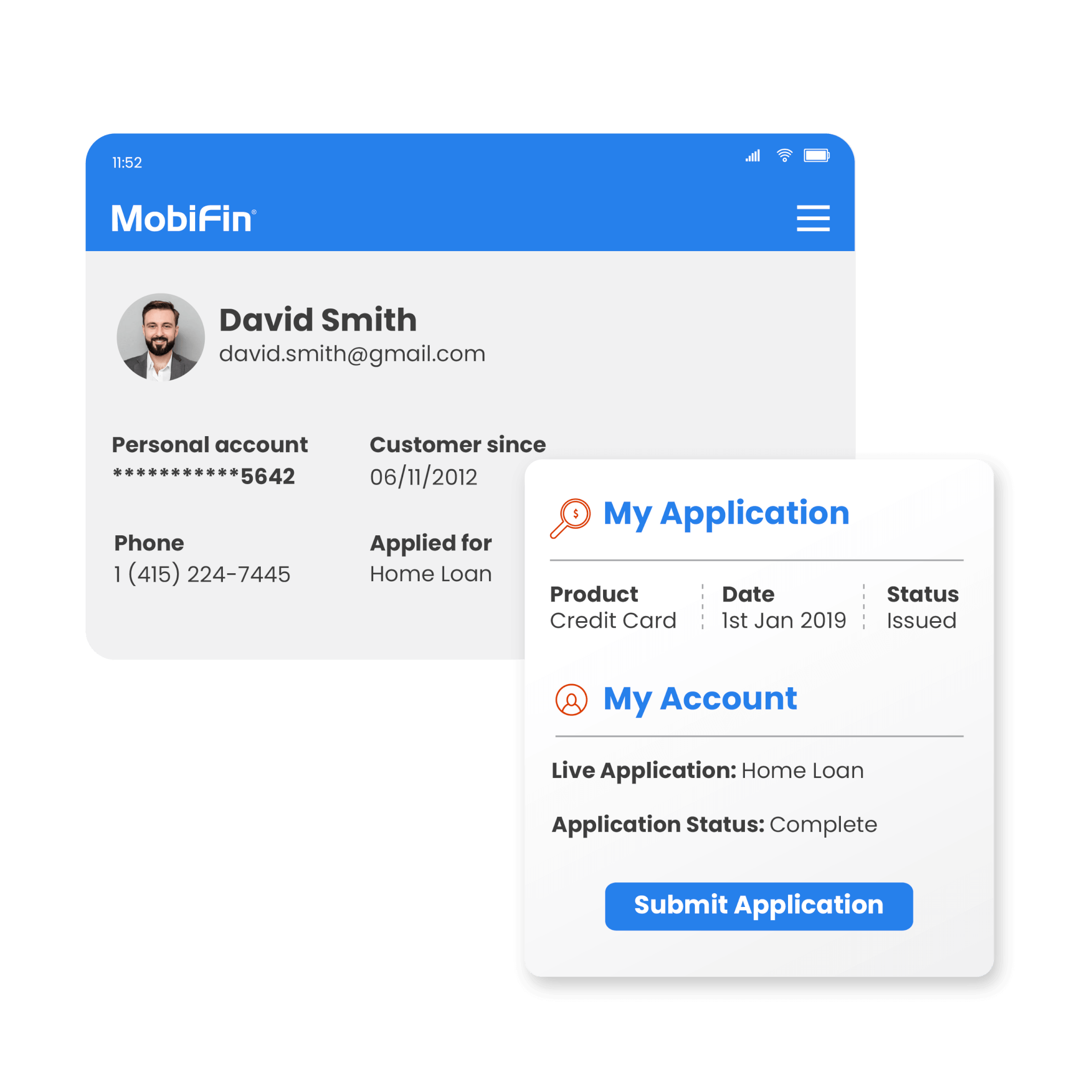

Loan and NPA management

These platforms provide centralized customer profiles enriched with essential details, transaction history, and up-to-date contact information. Banks benefit from a 360-degree view of customers, fostering personalized service and stronger relationships.

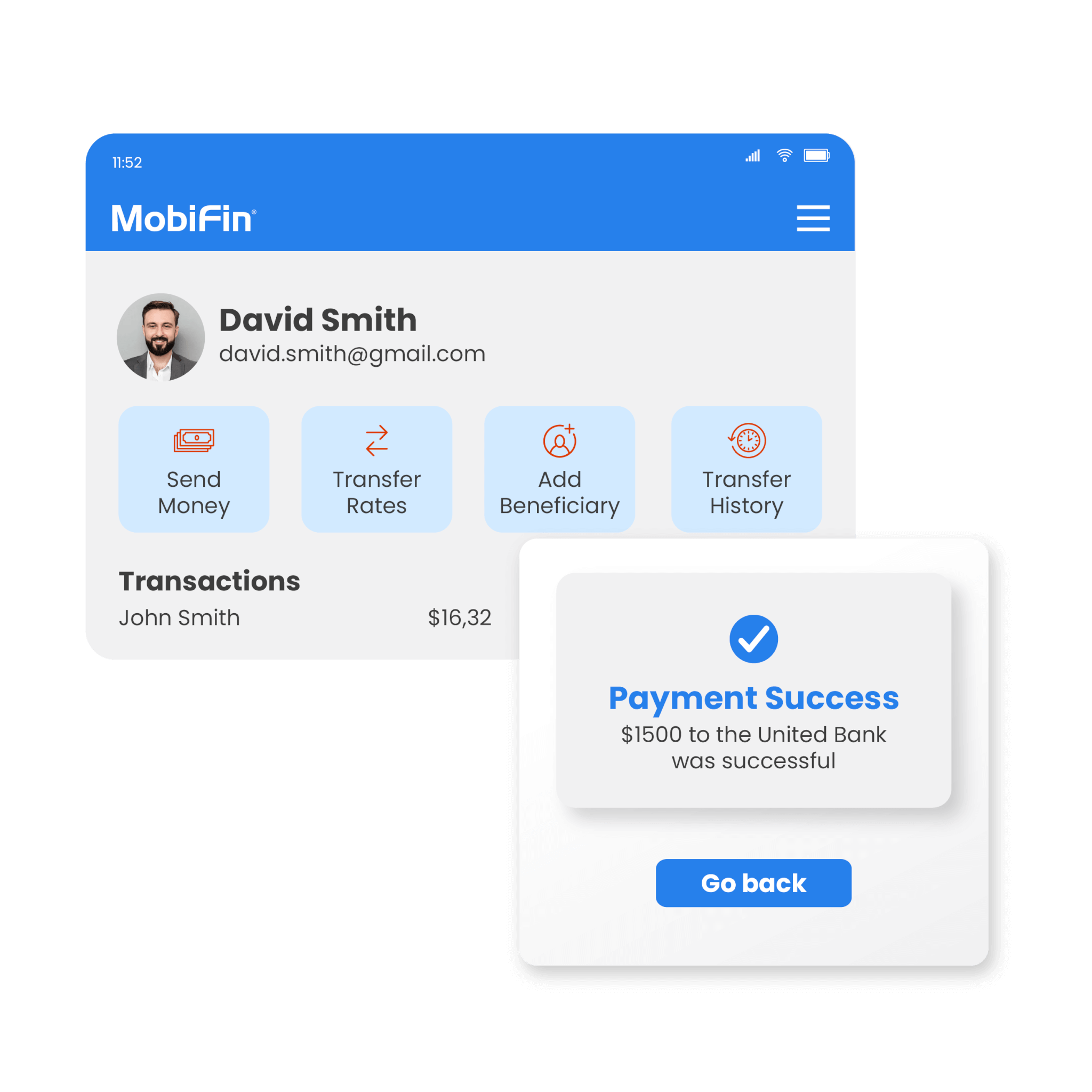

Cash management

Optimize cash flow for customers and the bank. Enable real-time balance inquiries, fund transfers, and overdraft facilities, enhancing financial control and liquidity management.

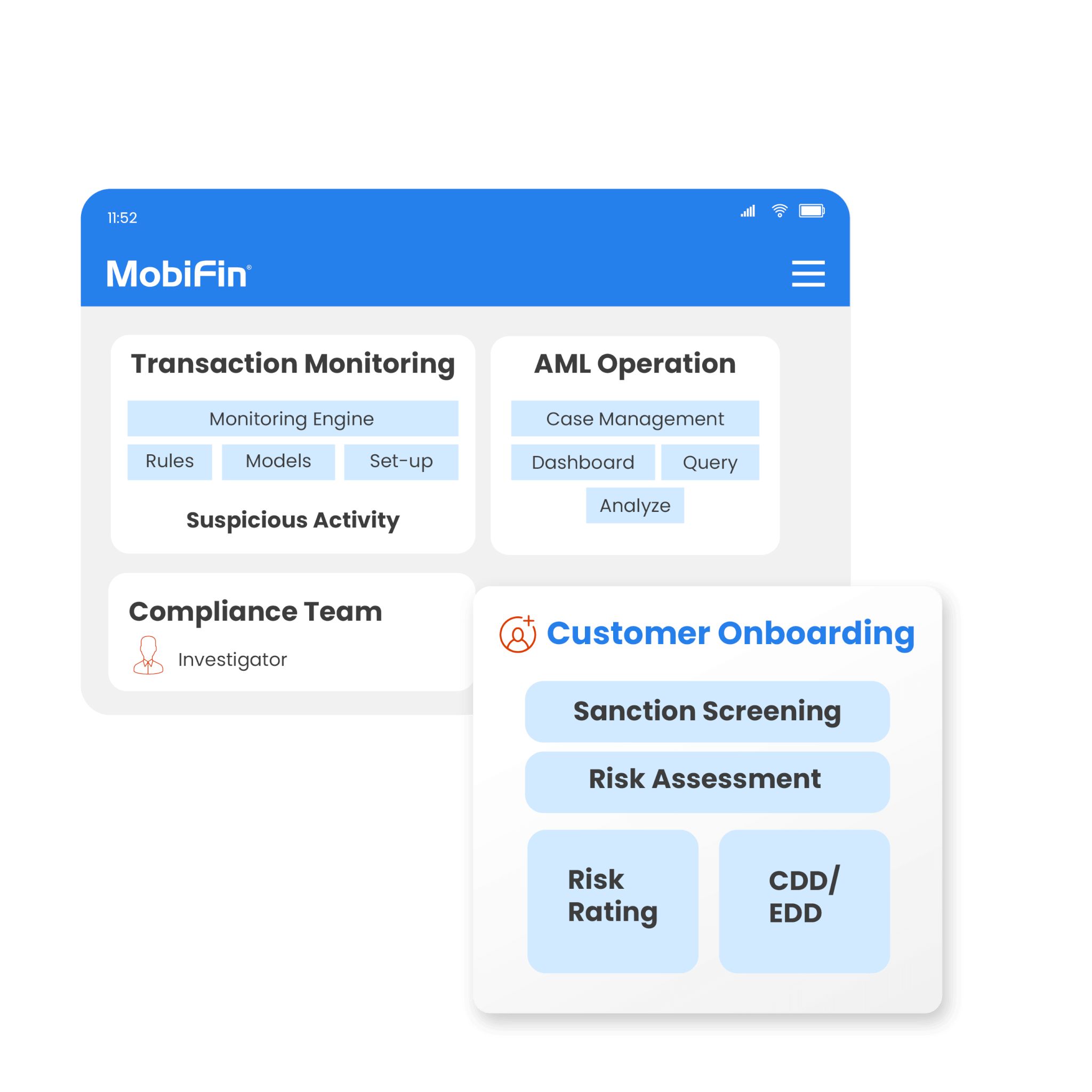

AML with CFT compliance

Combat financial crime and money laundering by integrating robust Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) compliance measures. Monitor transactions, flag suspicious activities, and file necessary reports.

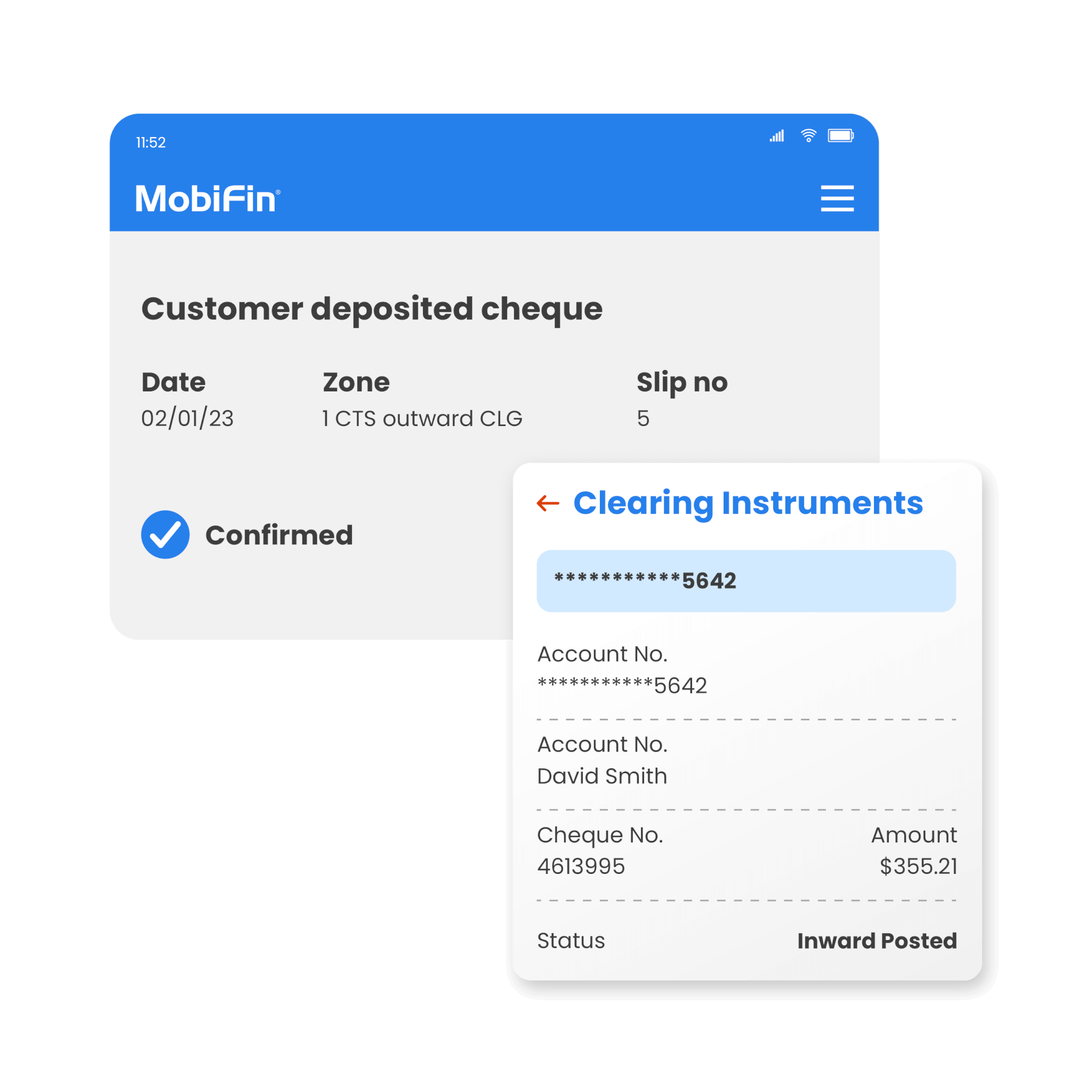

Centralized clearing and settlement

Banks can leverage MobiFin to create and manage a diverse portfolio of financial products, from loans to credit cards and investment offerings. This flexibility empowers banks to adapt to evolving customer needs and market trends, fostering competitiveness and growth.

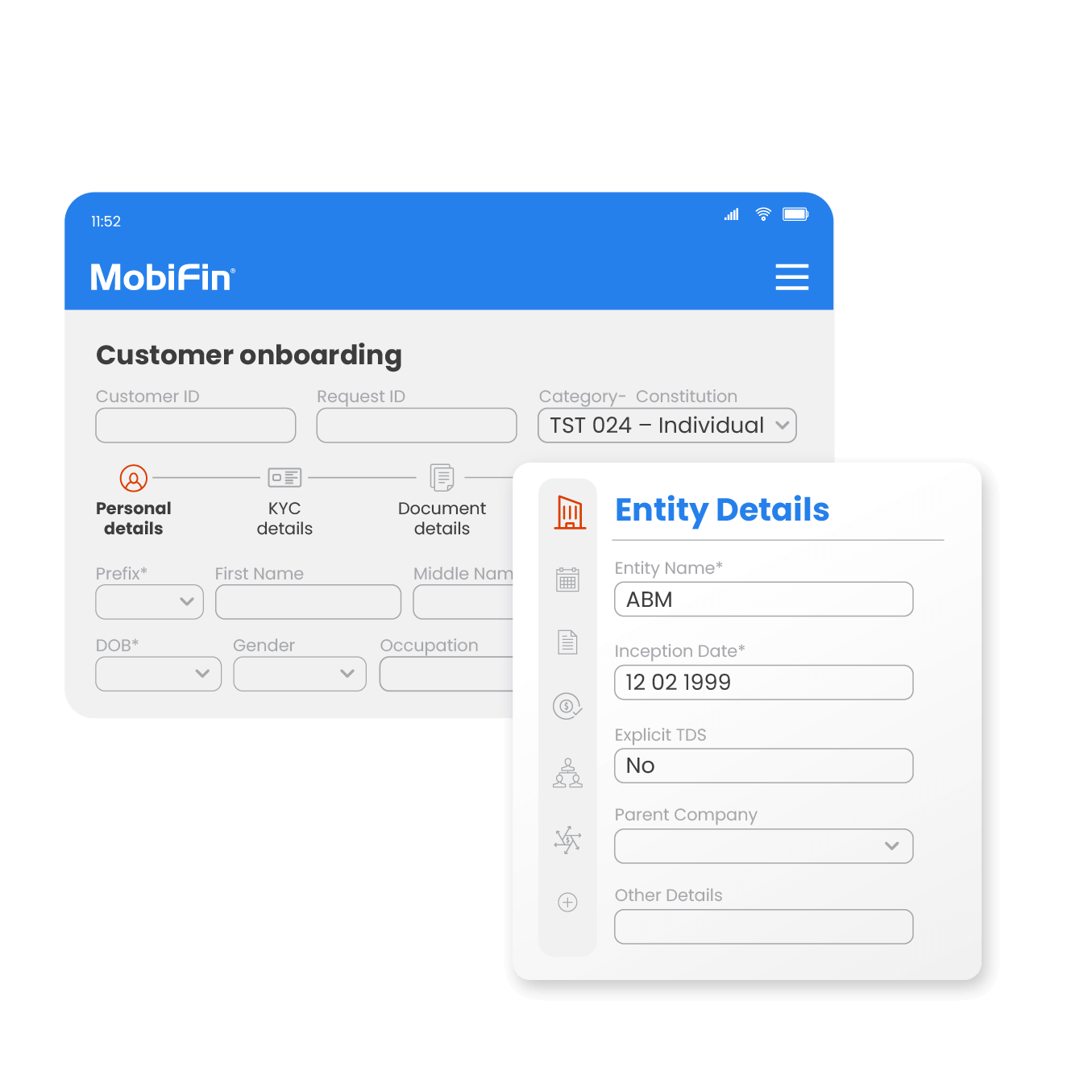

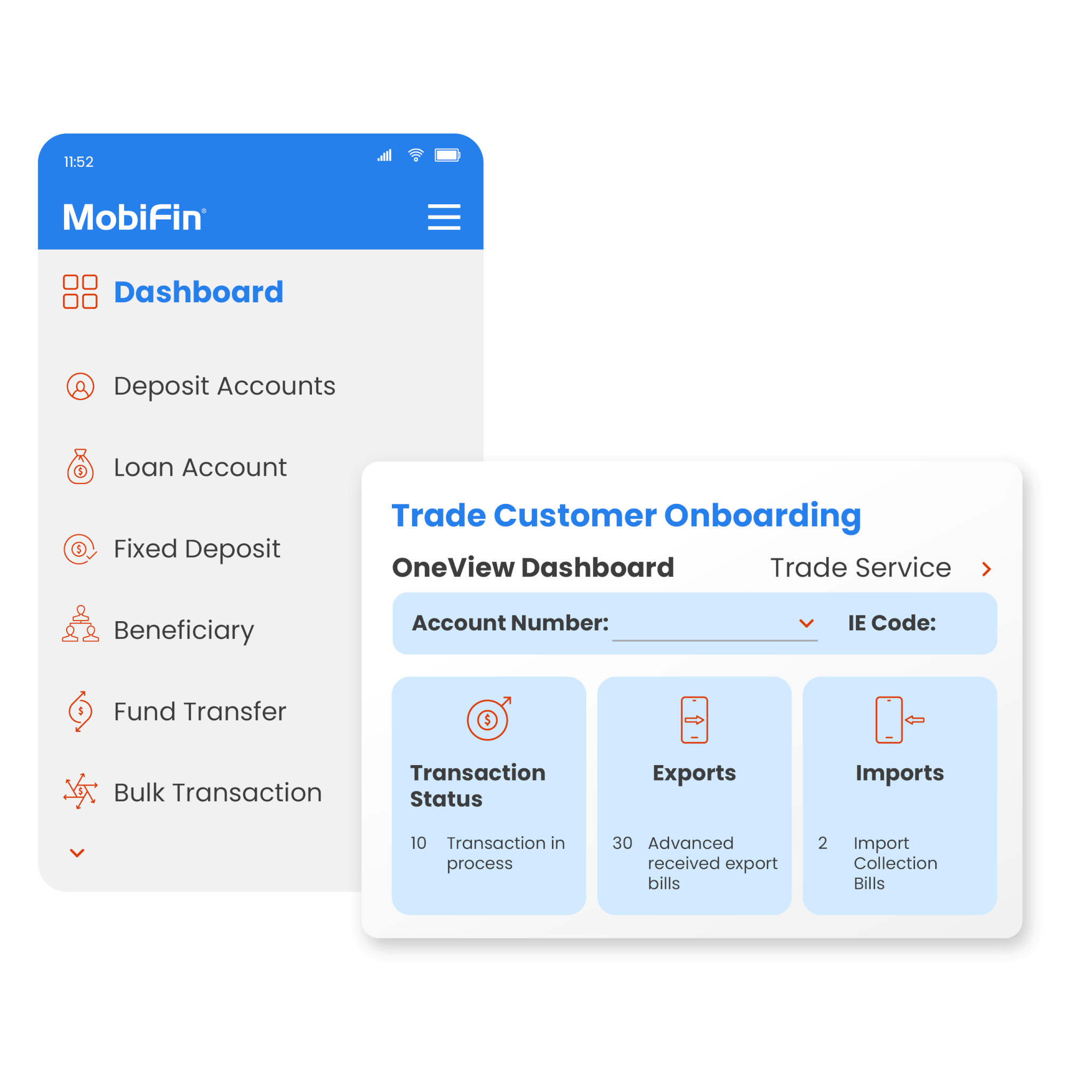

Customer onboarding

Integrate new customers seamlessly into the banking system and introduce products and services aligned with their financial objectives. The onboarding feature, available to retail and corporate clients, can be accessed through a self-service channel, agent-assistance or back-office processes.

Card management

Handle all card-related customer requests seamlessly through a centralized system, including issuing new cards, blocking existing ones, increasing credit limits, and renewing cards. These requests are automatically forwarded to the dedicated Card Management System (CMS) for processing and fulfillment.

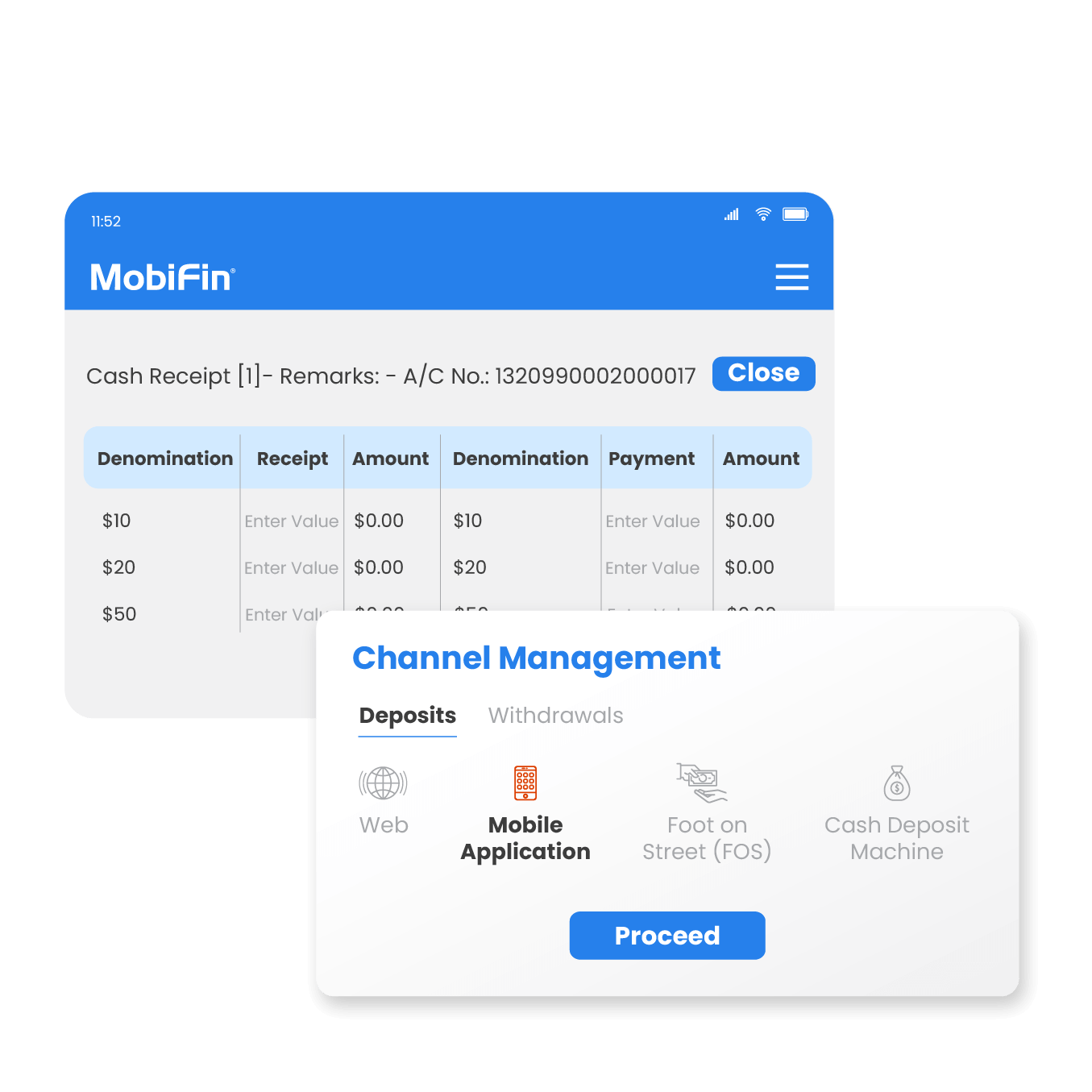

Teller and channel management

Manage teller and channel operations efficiently to ensure secure and timely cash transactions. Offer convenient cash deposits and withdrawals through a wide range of access points such as web and mobile banking platforms, Foot on Street (FOS) services for cash collection, and cash deposit machines to expand access to banking services.

Features

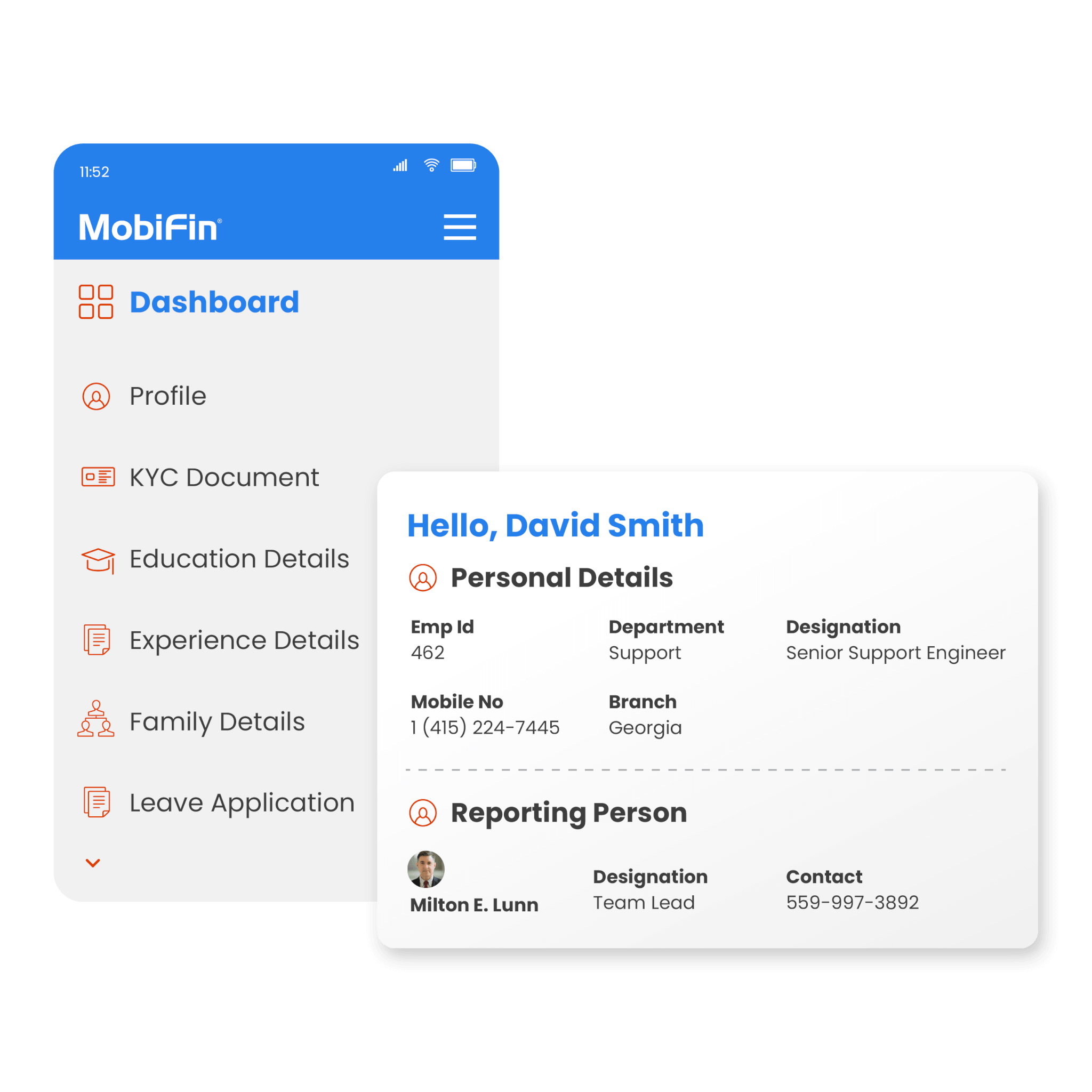

HR payroll

Efficiently manage payroll processing, including salary disbursement, tax deductions, and compliance. Provide self-service portals for employees, ensuring accuracy, timeliness, and regulatory adherence.

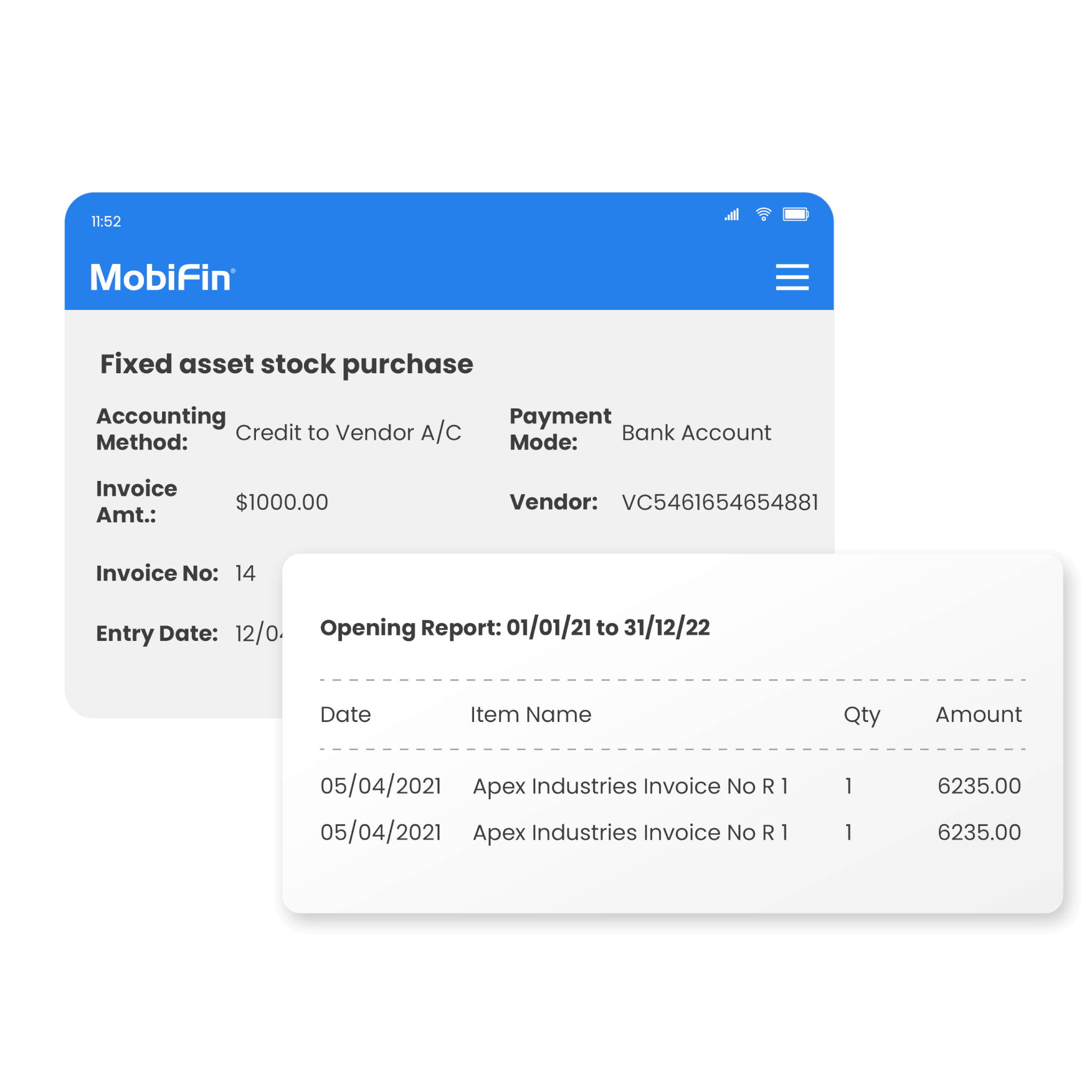

Fixed asset management

Track and maintain corporate assets, including depreciation calculations, maintenance schedules, and disposal records. Streamline asset lifecycle management to optimize resource allocation and financial reporting.

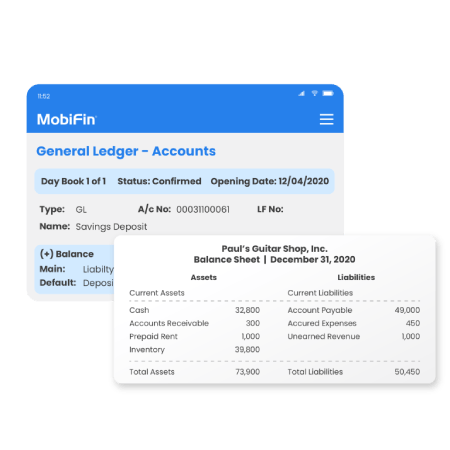

Real-time balance sheet

Access up-to-the-minute financial statements, including balance sheets, income statements, and cash flow reports. Ensure accurate real-time financial insights for informed decision-making and compliance.

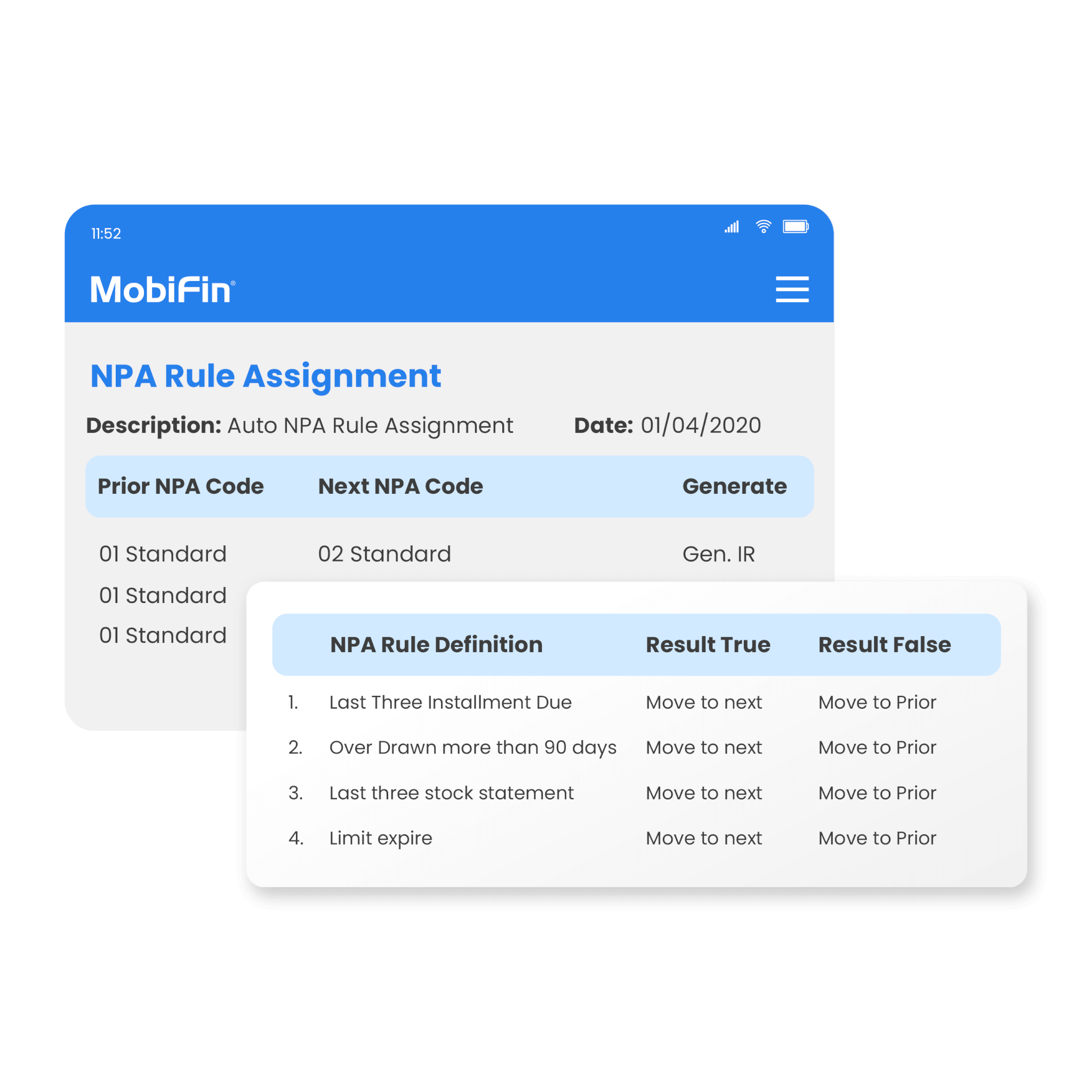

NPA management

Implement comprehensive Non-Performing Asset (NPA) management solutions. Identify, classify, and strategize the resolution of NPAs, minimizing credit risk and maximizing recovery efforts.

Trade finance management/treasury

Facilitate international trade with trade finance solutions, including letters of credit and export/import services. Optimize treasury operations with real-time fund management, risk hedging, and investment strategies.

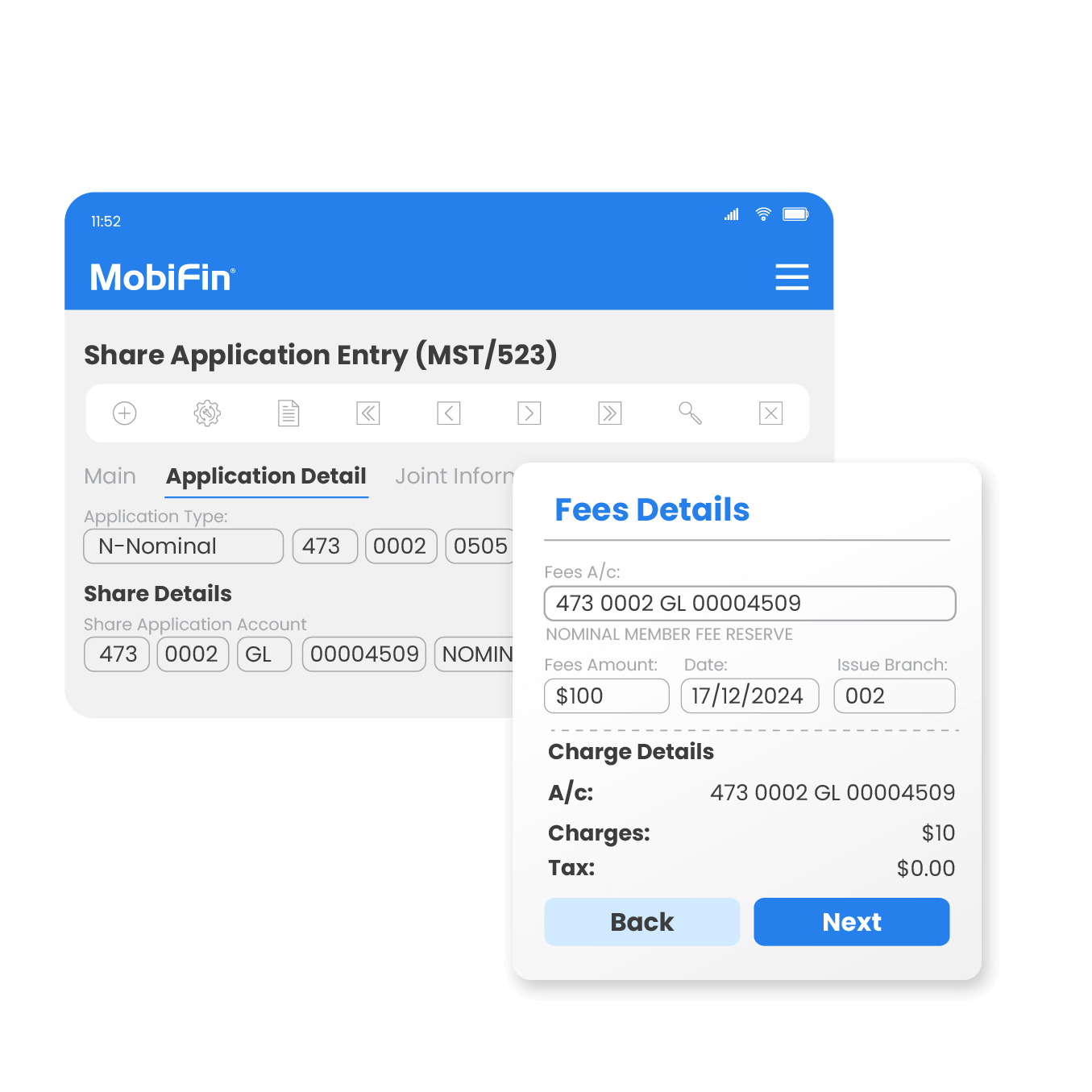

Shares module

Manage the issuance, ownership, and administration of members' shares effectively, especially within cooperative banks. Distribute profits to members as dividends based on their share ownership.

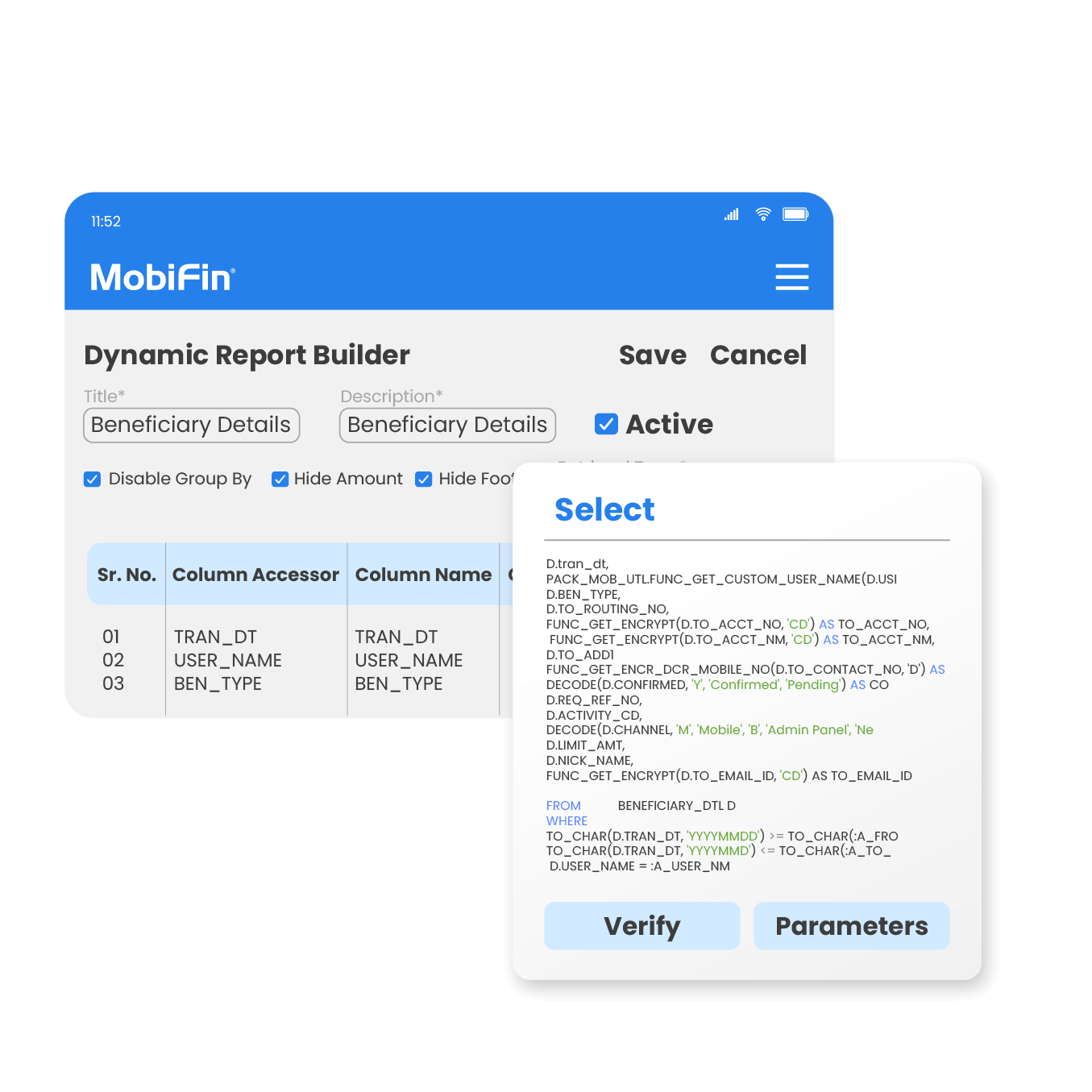

Custom report builder

Generate customized reports tailored to specific requirements directly within the platform. A dynamic report menu ensures easy access and navigation, empowering banks to monitor performance proactively while aligning with regulatory and compliance requirements.

Frequently asked questions

Yes, our CBS is highly customizable to accommodate your specific needs. We offer a wide range of solutions and services with configurable parameters to seamlessly integrate with your existing systems and processes.

Our CBS offers a data migration process that prioritizes data integrity and security. We conduct thorough post-migration audits and cross-checks using predefined checksums to verify data accuracy.

We offer integration capabilities with various third-party systems, such as payment gateways, electronic payment systems, payment aggregators, SWIFT systems, open API technology, CRM tools, clearing system integrations, and accounting software.

We implement stringent security measures, including encryption, access controls, and regular security audits, to protect sensitive information. Our solution is also designed to prioritizes data security and compliance through:

- Regulatory compliance: Adherence to IFRS-9 standards, CISA and VAPT compliance

- Enhanced security: 4-eye principle for additional oversight.

- Data integrity: Automated end-of-day and beginning-of-day processes with over 50 checks.

- Strong authentication: 2-factor authentication (SMS OTP & Biometric FP).

- Secure access: Rich Internet Application (RIA) for a secure user experience.

Our solution is built on a scalable architecture that can handle increasing transaction volumes and user base. Our versatile infrastructure and technology quickly adapt to your evolving business needs.

Our CBS features an integrated foreign exchange system that helps you mitigate risks by offering:

- Real-time foreign exchange rates

- Foreign exchange hedging tools

- Multi-currency accounts

- Foreign exchange forecasting

Our HQ module offers a range of functionalities including general ledger maintenance, user access management, NPA management, risk categorizing, bulk management, centralized EOM/EOY, e-circular management, document management, signature capturing, audit trail, configuration, and control.

We offer comprehensive support services, including technical assistance, software updates, and in-built report builder for ad hoc queries. Additionally, our dedicated support team is available 24/7 to address any issues and provide timely resolution.

Our CBS generates several crucial financial reports like capital adequacy, liquidity statement, statement of deposit return, statement of financial position, and statement of comprehensive income that provide insights into the bank’s financial health, regulatory compliance, and risk management practices.

Our CBS offers a range of cloud service models to cater to diverse needs. These include Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS).