Case Studies

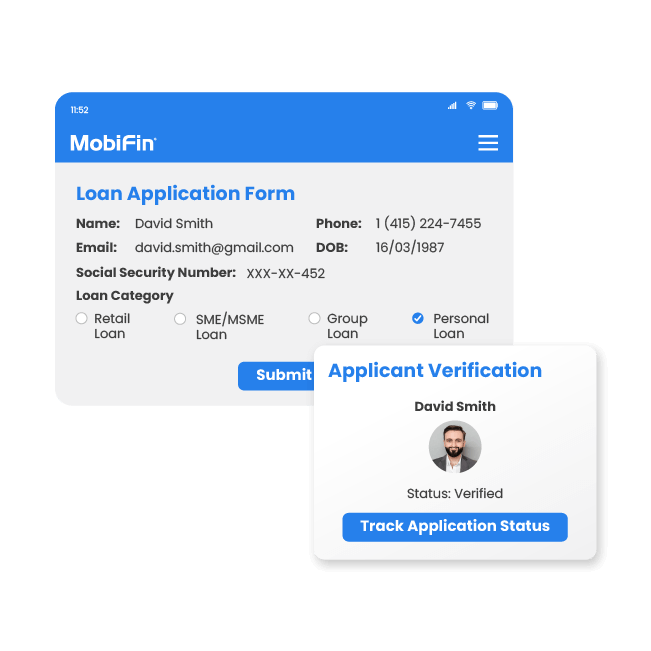

Loan inquiry

Serves as a customizable white-label application that allows users to submit loan inquiries. Guides them seamlessly through the application process, providing a frictionless start to their borrowing journey. Improves convenience while helping banks capture a higher number of qualified loan applications efficiently.

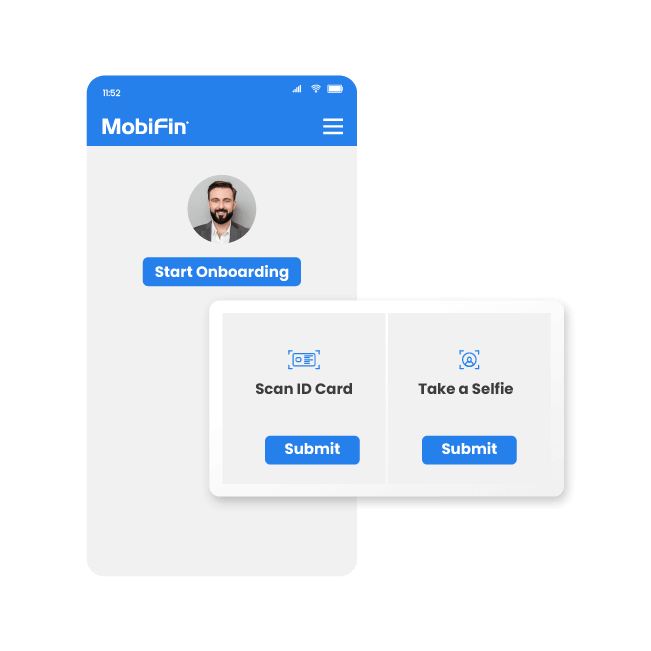

AI-powered digital onboarding

Streamlines onboarding with intelligent tools such as OCR, liveliness and deepfake checks, eKYC, sanction screening, and AML compliance for secure, efficient verification and risk management. Delivers instant, compliant onboarding while minimizing fraud risks. Reduces operational costs and accelerates customer acquisition, while building trust and satisfaction.

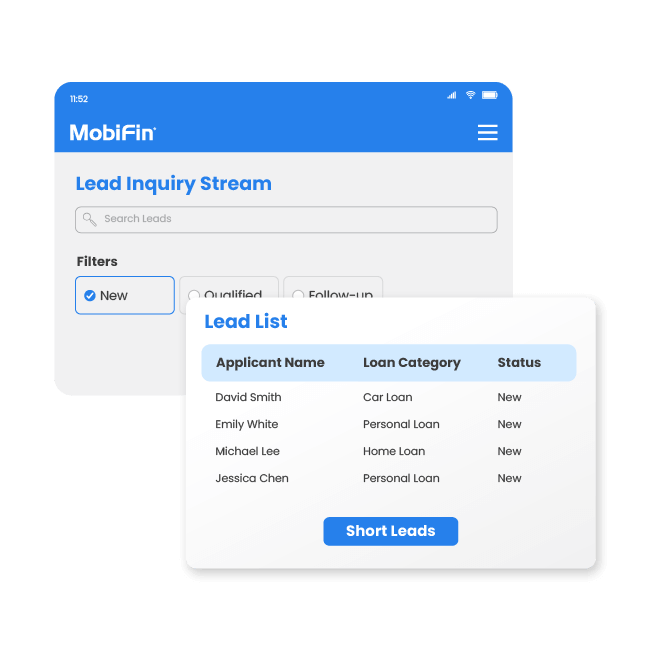

Lead management

Simplifies the lead inquiry process for financial institutions and enables easy tracking and communication. Streamlines the selection of eligible leads for further processing. Improves efficiency by ensuring faster lead qualification, stronger engagement, and higher conversion rates. Maximizes revenue opportunities for institutions with minimal effort.

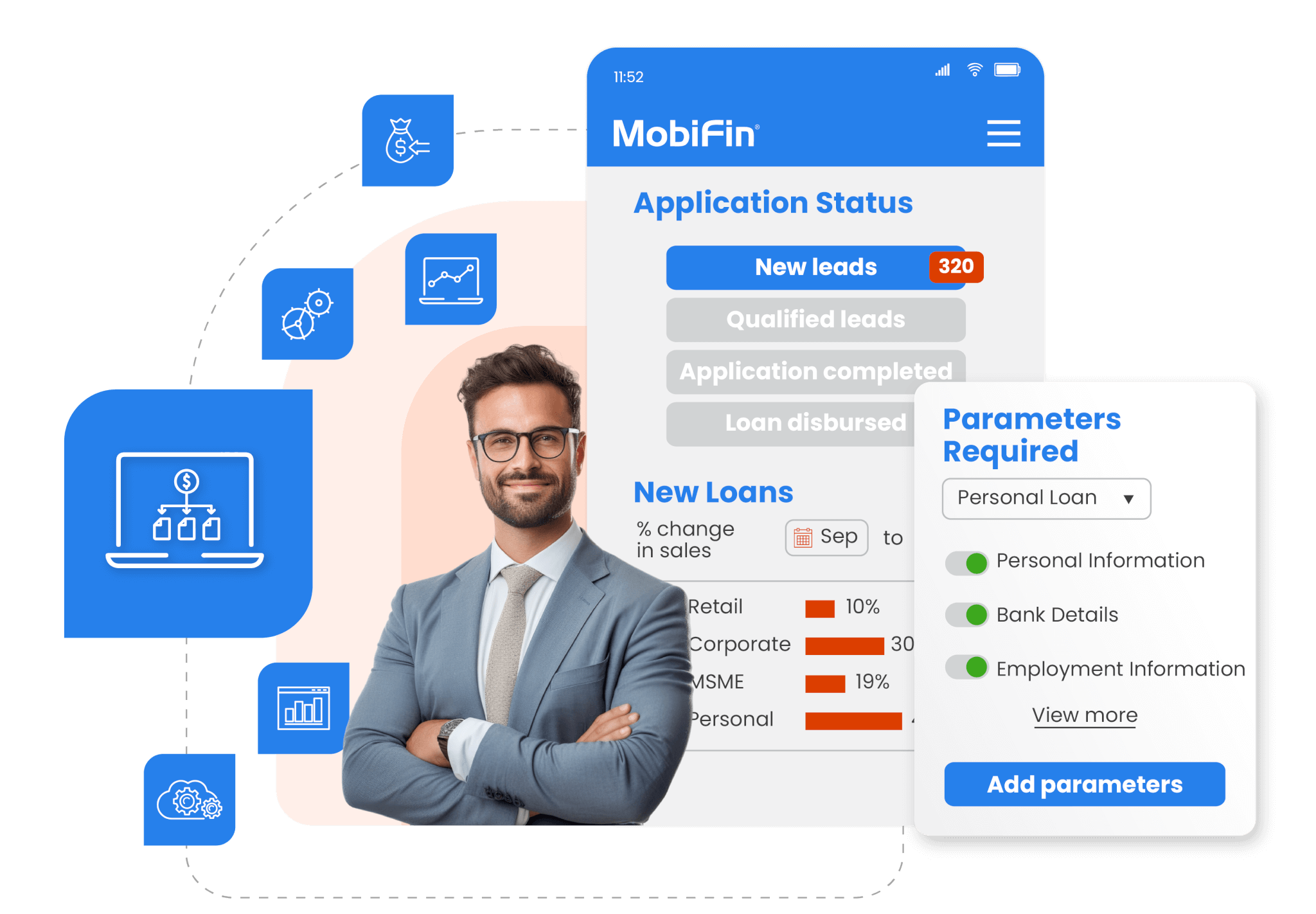

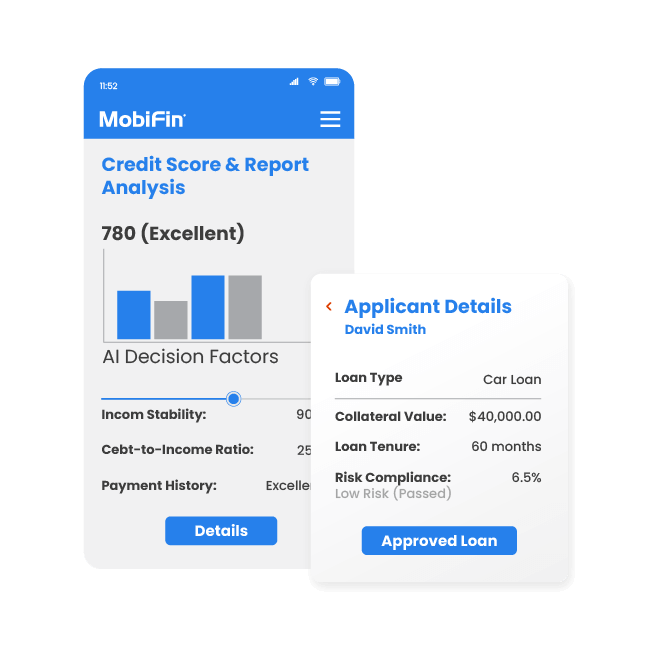

Smart underwriting

Automates credit assessments using AI to evaluate applicant creditworthiness and determine loan terms. Reduces manual intervention while ensuring consistent data-driven decisions. Enables faster loan approvals through AI-powered risk evaluation. Strengthens customer confidence and improves portfolio quality by delivering fair, transparent decisions.

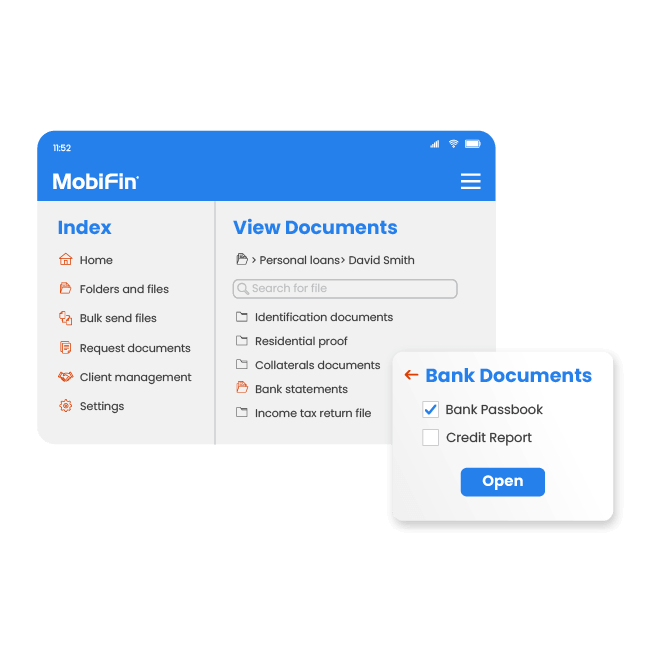

Advanced document processing

Leverages advanced NLP and AI to extract structured data and auto-draft credit and sanctioning documents. Supports interactive AI chats to reference files and produce complete documentation. Streamlines workflows to reduce processing time and human errors. Enhances compliance and accelerates disbursements for both banks and borrowers.

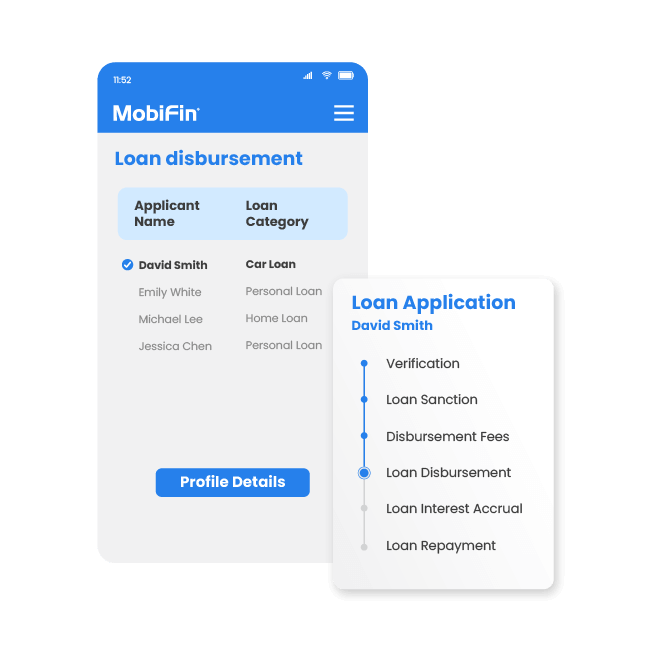

Loan account disbursement

Covers borrower KYC, loan account setup, collateral documentation, phased or full disbursement, repayment schedule configuration, and fee processing. Ensures faster loan activation, transparent repayment schedules, and accurate fee handling, giving borrowers seamless access to funds with confidence.

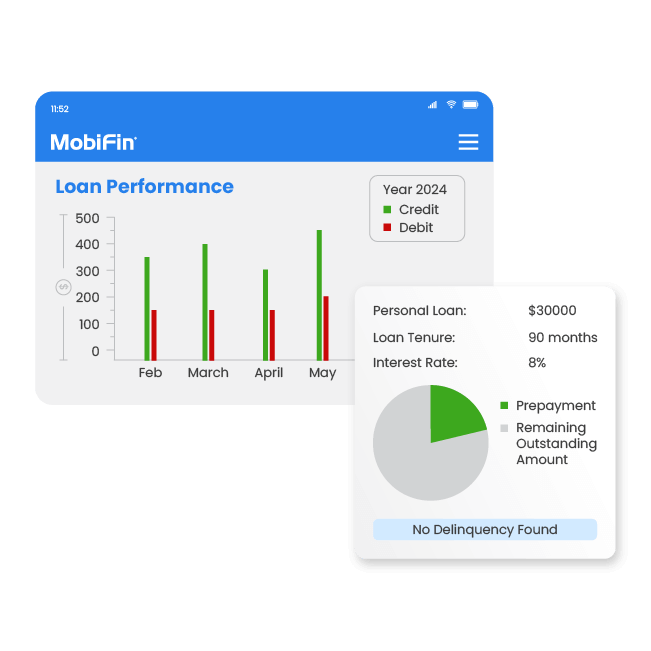

Loan servicing

Manages loan collection (digital, cheque, standing instructions), account maintenance, interest calculation, insurance submission, and restructuring (refinance, tenure adjustment). Provides flexible repayment options, precise interest handling, and proactive restructuring support. Helps borrowers manage commitments seamlessly while enhancing satisfaction and retention.

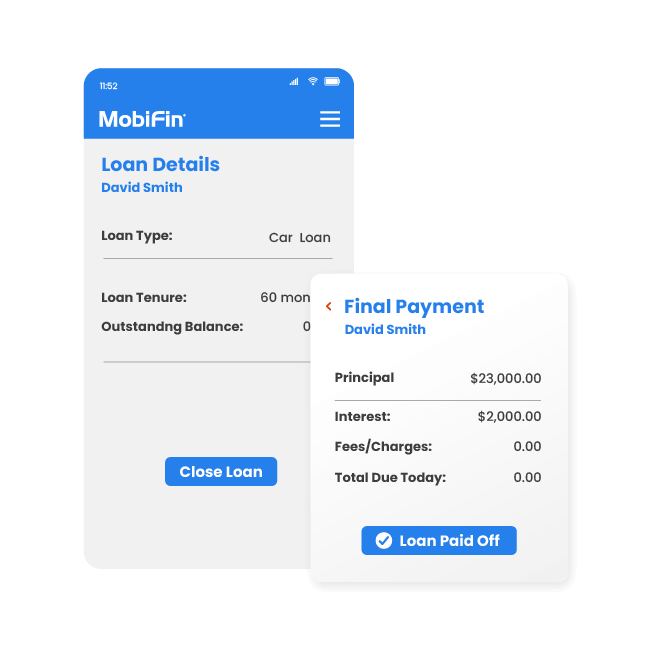

Loan closure

Oversees arrears monitoring, early warning alerts, recovery, repossession, legal actions, write-offs, and closure documentation. Simplifies closure with clear records, prompt issue resolution, and recovery support. Ensures borrowers experience hassle-free completion and fosters long-term trust.

Frequently asked questions

Yes, MobiFin ‘s LOMS is highly customizable and can be tailored to meet the specific needs of various loan products like personal loan, home loan, consumer loan, and business loan. Its flexibility allows lenders to configure different loan structures, risk assessment models, and pricing strategies. It is totally adaptable to evolving market conditions and borrower needs.

Yes, MobiFin’s LOMS provides open APIs, allowing for easy integration with internal and external systems such as credit bureaus, core banking systems, and third-party data sources, for improved data accuracy and process efficiency.

Our LOS integrates regulatory requirements into workflows, reducing errors and ensuring adherence to legal guidelines throughout the process.

Yes, we offer comprehensive workflow automation, streamlining your entire lending process from prospecting to servicing. You can design, deploy, execute, track, and administer your business processes, ensuring efficiency and reducing manual errors throughout the loan lifecycle.

Yes, MobiFin LOMS provides tools to streamline regulatory reporting and generate the necessary reports and documentation for audits.

Yes, MobiFin LOMS provides robust portfolio management capabilities, including tools for tracking loan performance, analyzing risk exposure, and identifying potential problem loans. Lenders can use these features to proactively manage their loan portfolios and mitigate risks.

Yes, terms and conditions, negotiation and approval functionality can be customized on a per-product and per-lead basis.

Yes, our LOMS integrates with credit bureaus and offers built-in credit scoring models to help you evaluate the creditworthiness of loan applicants. It provides comprehensive credit reports, risk assessments, and decision-support tools.

Our LOMS platform is designed with data security and compliance as top priorities. We adhere to industry regulations and offer in-built modules that generate regulatory and audit reports tailored to your specific requirements.

Yes, MobiFin offers both on-premises and cloud-based deployment options for its LOMS solution, providing flexibility and quick scalability.