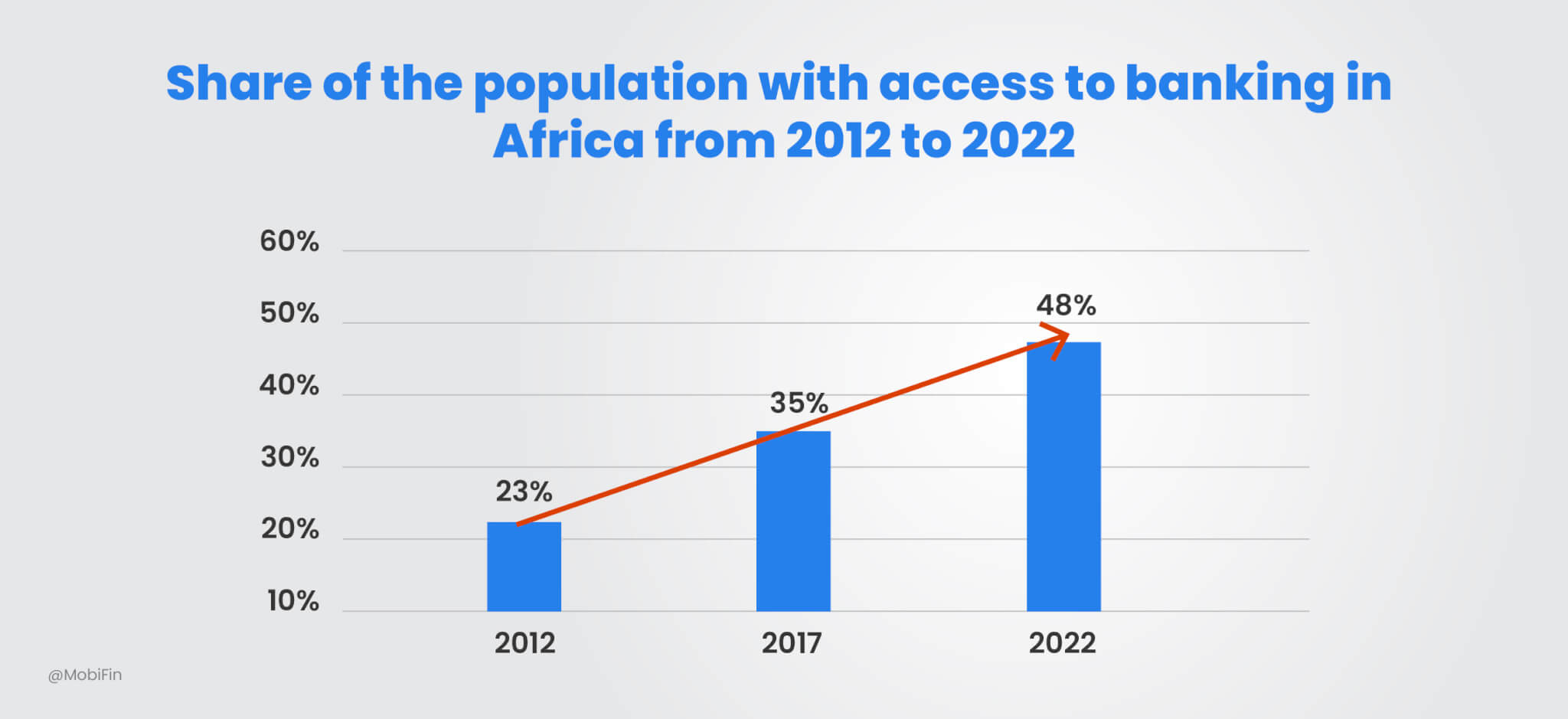

But change is on the way: Agency banking is stepping up to bring banking right to people’s local shops and businesses—places they already know and trust. And now, the Aggregated Agency Banking model is taking it even further. This model is reaching more communities than ever, making banking as simple as a stop at the corner store. It’s a game-changer, providing millions with convenient access to financial services right where they live.

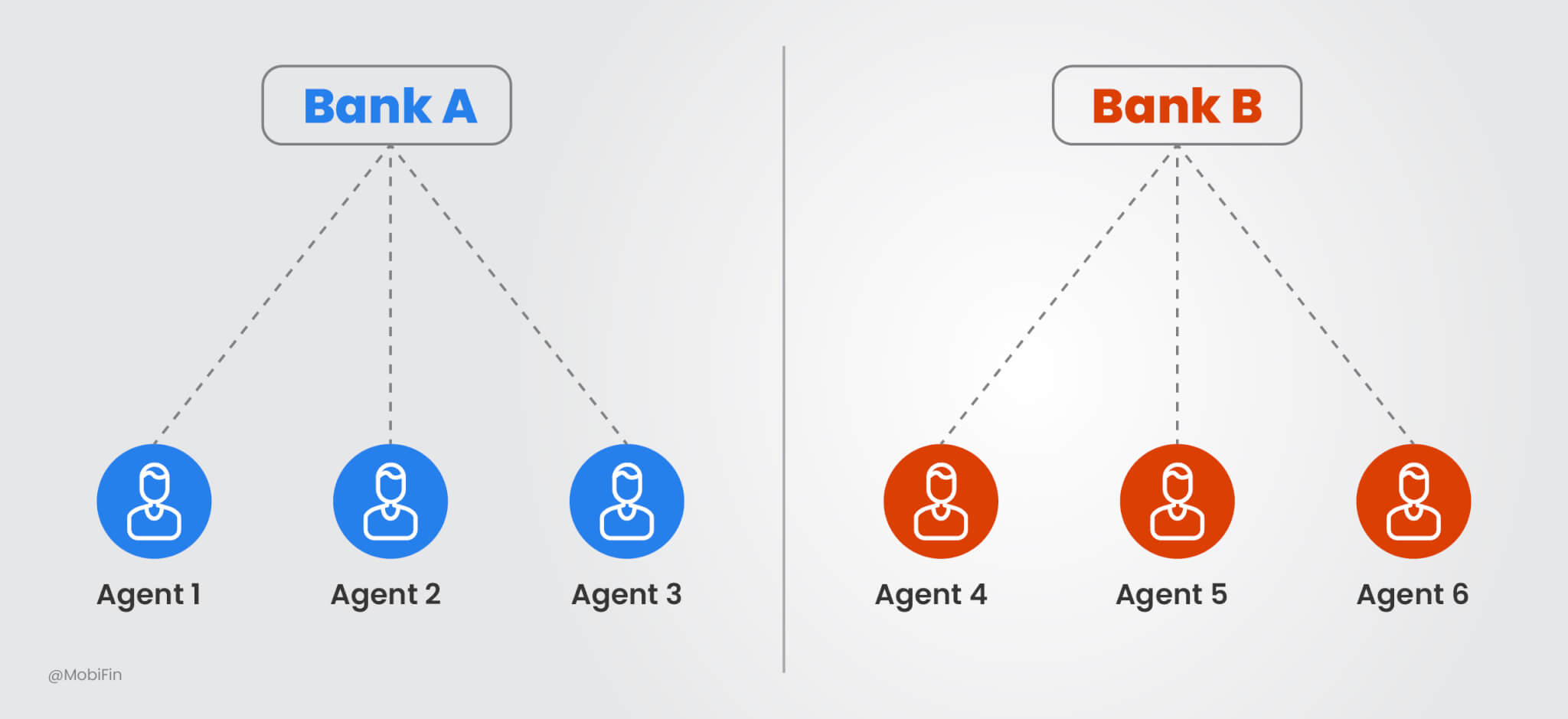

What is the direct model of agency banking?

Let’s take an example of a bank. Let’s call it “Bank A”, that wants to offer banking services. To do this, Bank A onboards and trains local agents to represent their bank, making these agents a direct extension of their team. Direct Agency Banking model enables Bank A to implement this approach, where agents assist customers with deposits, withdrawals, balance inquiries, and bill payments, all while following Bank’s guidelines.

Because these agents work exclusively for Bank A, the bank has full control over the service experience, ensuring consistent, high-quality interactions. However, if another bank also wants to operate in this village, they will need to recruit and train their own agents. As a result, each bank builds its own network of agents, forming what we call the direct model of agency banking—a more personalized approach to reaching customers.

Highlights of the Direct Model:

- Exclusive Relationship: Agents work only for one bank.

- Bank Control: Bank controls all aspects, from training to security, to ensure consistent service.

- Cost Saving: Instead of establishing new branches or ATMs, the bank can rely on agents to reach a wider customer base while reducing infrastructure costs.

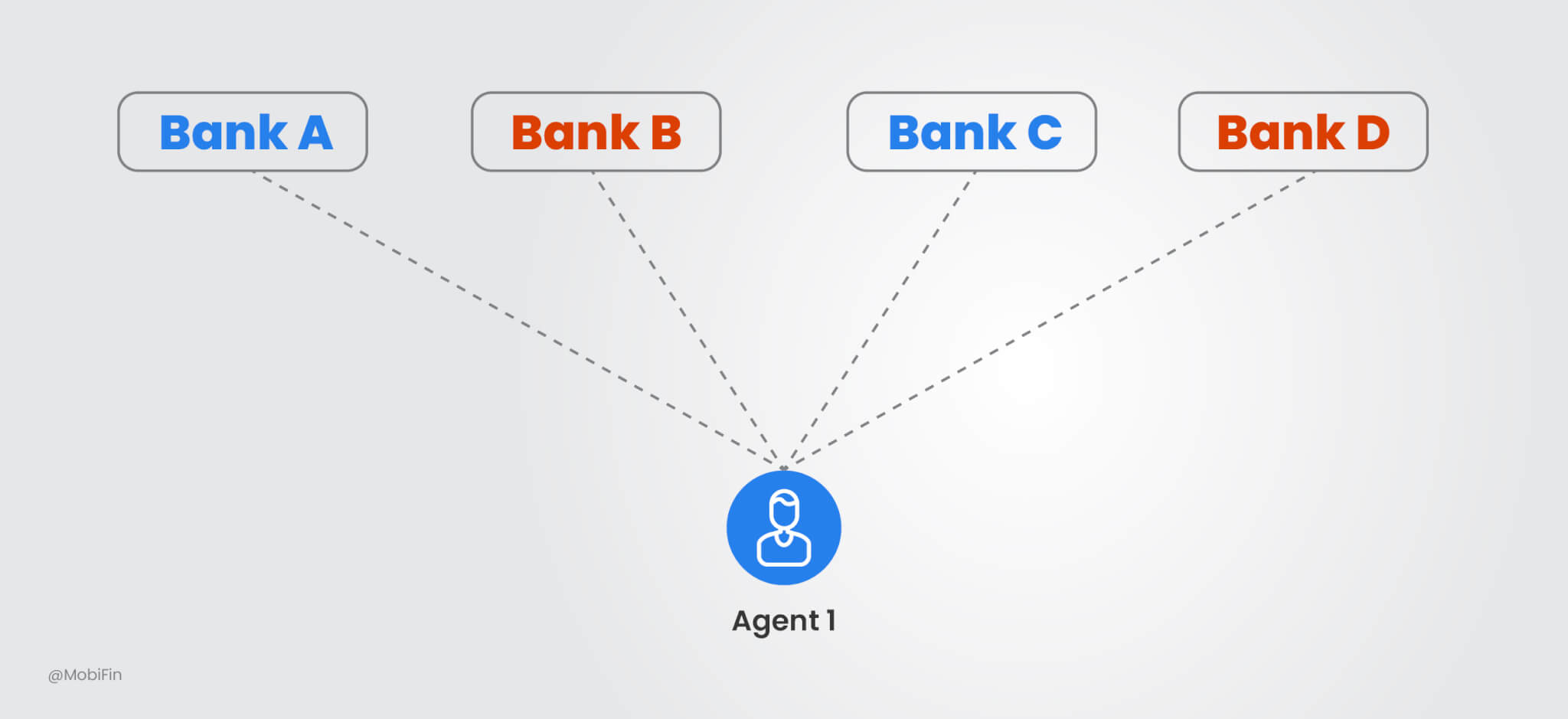

What is the aggregated model of agency banking?

Imagine a single place where you can access services from multiple banks—not just Bank A, but also Bank B, Bank C, and Bank D. That’s the magic of the Aggregated Model of Agency Banking. Instead of each bank setting up its own agent network, they collaborate with an aggregator that already has a strong agent network. This allows one agent to provide services for all the banks, creating a simple, one-stop shop for banking.

Now, you might be wondering—who can become an aggregator? Any organization with a strong agent network and the right infrastructure can step into this role. Take, for instance, a nationwide postal network. With its extensive reach and trusted postmen who already deliver services in remote areas, it is perfectly positioned to serve as agency banking agents. Imagine a postman not just delivering letters but also helping people to open accounts, withdraw cash, or pay bills on behalf of multiple banks. Similarly, any organization with a robust agent network and the right infrastructure can take on this role. They can bring banking services right to the doorstep of even the most remote communities.

This model brings both convenience and flexibility. The agent only needs to go through a single training process, allowing customers from different banks to perform transactions at one location. By sharing resources, Aggregated Agency Banking model makes the entire process faster, simpler, and more cost-effective for everyone involved.

Highlights of the Aggregated Model:

- Multiple Banks: Agents can provide services for several banks at once.

- Shared Platform: A central aggregator manages agent training and support, which reduces costs for banks.

- Wide Reach: Banks can expand faster and cover more locations by using shared agents.

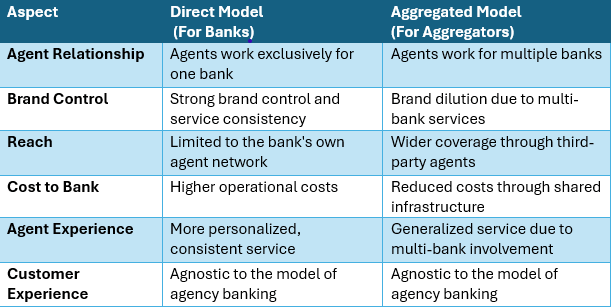

Direct model vs Aggregated model

Choosing the right agency banking model depends on an institution’s priorities. The Direct Model strengthens customer relationships through dedicated agents, giving banks complete control over their brand and service quality. The Aggregated Model offers a wider reach and cost efficiency by utilizing agents who work with multiple banks. Below are the key differences between these two models:

How MobiFin can help in both models

MobiFin offers a flexible and powerful platform that enables banks and aggregators to implement both Direct (for Banks) and Aggregated (for Aggregators) Agency Banking models. Here’s what sets MobiFin apart and makes it uniquely effective:

- Multi-level role management

MobiFin platform allows banks to assign roles and responsibilities across different agent levels according to their needs, making it easy to manage both Direct (exclusive) agents and Aggregated (shared) agents. This helps keep operations efficient and organized. - Smooth agent onboarding

MobiFin makes onboarding quick and easy with customizable KYC templates and approval workflows that fit your needs. This ensures secure and reliable agent networks, while multi-step verification keeps banks compliant and safeguarded against risks. - Diverse transaction options

MobiFin offers a variety of transaction methods—including cash, card, and cardless (Token-based) transactions—empowering banks to deliver a comprehensive suite of services to their customers. - Seamless bill and utility payments

Paying bills has never been simpler. With MobiFin’s biller integrations, agents can handle everything from utility payments to other essential services. This helps customers save time and gives banks the flexibility to serve better in both Direct and Aggregated models. - Smart agent commission management

MobiFin simplifies agent commission management by handling every step—accrual, clawback, and disbursement. This enables banks to ensure accurate and timely payments to agents, whether they operate on behalf of a single institution or multiple banks. - Personalized application for agents

MobiFin provides each agent with a mobile or POS application, packed with features tailored to their specific role. Direct agents can present the bank’s brand, while Aggregated agents can seamlessly manage operations across multiple banks.

With MobiFin, banks and aggregators can confidently deliver both Direct and Aggregated models, empowering financial inclusion and enhancing operational efficiency.

Conclusion

Both the Direct and Aggregated models of agency banking play a crucial role in enhancing financial inclusion, making banking services more accessible—especially in remote and underserved areas. Each model has its unique benefits and challenges, and the best choice depends on the bank’s objectives and resources.

The Direct Model gives banks greater control over the customer experience. This means they can ensure high service quality and maintain brand consistency—ideal for banks that want to offer personalized service.

On the other hand, the Aggregated Model provides a flexible and cost-effective way for banks to grow quickly and reach customers in even the most remote areas. This model allows banks to partner with aggregators, providing customers with more options in areas that need diverse banking services.

Ready to transform your agency banking experience? Contact us today for a demo and discover how MobiFin can help you achieve success with either the Direct or Aggregated model.