Are you ready for a bank that cares about your financial future?

- Let’s say a bank onboards a new, younger customer who is just getting established. They may have a certain amount of debt, no substantial savings, and a very low level of financial knowledge, thus dealing with banks may cause them anxiety – particularly when deciding which bank to begin with.

- If the bank prioritizes financial wellness in their offerings, they will help customers manage spending, encourage saving small amounts for debt repayment, and establish a modest emergency fund.

- As a result, a new approach is emerging, one that prioritizes financial wellness as a key component of omnichannel banking services.

- By incorporating financial wellness into their digital banking platforms, banks can provide added value to their customers, strengthen customer relationships, and differentiate themselves from competitors.

This blog delves into why incorporating financial wellness services into omnichannel offerings is becoming a major aspect of banking and why banks need to be customer-centric in looking for ways to help customers manage their money and improve their financial wellness across the US and MENA regions.

What is financial wellness?

Financial wellness is more than just financial wealth. While wealth often focuses on bank balances and net worth, well-being encompasses how your money management practices impact your overall quality of life. It’s about being financially secure, prepared for unexpected events, saving for future goals like retirement, and having the freedom to make choices that enhance your enjoyment of life—now, in the future, and even during challenging times.

Major elements of financial wellness offerings

1. Personal finance analysis and predictions

In today’s uncertain economic climate, personal finance has become a top priority for many Americans. With rising expenses and the threat of financial crises, individuals are seeking reliable tools and guidance to manage their money effectively. Fortunately, advancements in technology have paved the way for innovative solutions in personal financial management.

- The 2024 Annual Report on Personal Finance in America revealed that nearly 60% of Americans believe that the expenses of daily living are increasing, leading to a decline in savings. Rising prices are causing budget margins to shrink, making it increasingly difficult to save money for the future.

- Furthermore, 40% of Americans reported experiencing a sudden financial crisis in the past three months. This data highlights the strong need for customized financial services and the confidence clients have in analytical data to improve their banking interactions.

For instance, with Mobifin’s personal financial management (PFM), banks can build stronger customer relationships (cross-selling opportunities) by offering personalized support, educational resources, and innovative tools. As a result, banks can play a crucial role in helping their customers achieve financial security and peace of mind.

2. Effective financial wellness strategy boosting customer engagement and loyalty

Customer engagement has become a necessity in the banking industry. By prioritizing customer needs, delivering better experiences, and leveraging data-driven insights, banks can differentiate themselves from competitors and achieve growth. Providing an effective financial wellness strategy by offering tools that help consumers reduce debt and improve credit further supports long-lasting relationships, benefiting both the institution and the consumer.

- Financial wellness programs serve as an educational bridge, helping customers better understand banking products and services at their disposal.

- Customers are naturally more open to using products they genuinely understand and trust, which further leads to increased customer engagement rates.

- Loyalty is the cornerstone of a bank’s success. By offering digital financial management solutions, banks signal a genuine commitment to their customers’ financial wellness. This commitment fosters trust and loyalty, paving the way for long-term customer retention.

- Therefore, by facilitating these understanding, banks can drive better customer engagement on their digital platforms.

3. Benefits of financial wellness to employees

Employees have more challenges than just saving for retirement. Financial stress is an enormous concern for today’s employees and providing support for financial wellness can not only lead to gains in productivity and help stave off physical and mental health concerns down the road. Moreover, an effective financial wellness offering can also lead to a more inclusive and equitable workplace and a more productive, engaged workforce.

- With inflation hitting hard in 2023, employee financial stress is on the rise as workers navigate higher prices, uneven wage growth and record credit card debt.

- Organizational changes can cause employee stress, and PwC survey found that the top cause of stress is financial wellness. 60% of full-time employees are financially stressed, which is slightly higher than the number who were financially stressed at the height of the pandemic. Even among employees earning $100,000 or more per year, nearly half (47%) feel stressed about their finances.

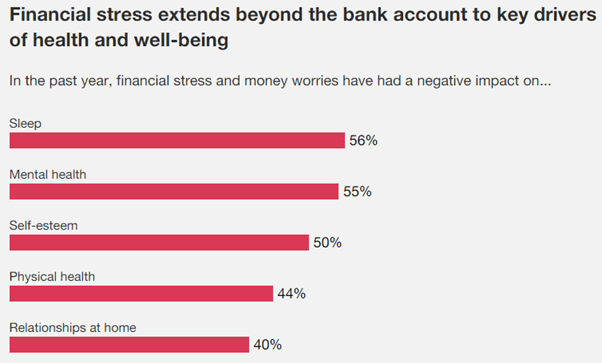

- Additionally, financial stress impacts a wide range of areas related to employee health and well-being, from mental health to sleep to self-esteem. Therefore, there is a massive potential for banks and Fintechs to move with personal finance management offerings towards corporate sector.

The illustration below shows that how much negative impact of financial stress/money worries have on employees:

4. Help users to make smarter financial decisions

With multiple expenses and bill payments, managing income can be overwhelming. In recent years, financial wellness has become more relevant, especially for youth who start to earn money, buy things on their own, manage a bank account, or borrow for education. Strong financial knowledge and decision-making skills help people weigh options and make informed choices for their financial situations, such as deciding how and when to save and spend, comparing costs before a big purchase, and planning for retirement or other long-term savings.

- One of the most popular benefits of implementing data-driven technologies is that banks can provide a rapid overview of their customers’ financial situation. Whether they’re seeking advice, making transactions, or monitoring their investments, financial wellness solutions are known for their agility in addressing user requirements through digital banking platform.

- Everyone wants to be financially healthy, but many people have difficulty attaining that goal. According to a study conducted by the Swiss banking group UBS, over half (54%) of women in the MENA region perceive their understanding of investments & financial wellness as low, despite the exponential growth of their wealth in the region.

- With an increasing number of women emerging as business leaders in the MENA region, there is evident proof of women becoming smarter and actively engaged in decisions related to their financial well-being.

- Consequently, financial wellness solutions through omnichannel experience help users stay on top of their money and make smarter and more informed financial decisions.

5. Financial wellness across Gen Z

When it comes to financial wellness, Gen Z is extremely curious and interested in financial wellness products and services. They worry about planning their financial future and about not spending their money on unnecessary or extravagant things, but above all, they worry about saving money. According to Bankrate’s recent financial wellness survey, over half of Gen Z respondents say that financial concerns have a negative impact on their mental health, which can make it all the more difficult to focus on and manage finances.

- As the first generation to be purely digital natives, Gen Z sees much of their life being influenced and shaped by the data they create, whether through social media, their use of smartphone apps, or their education and leisure activities.

- Much of the commentary has focused on the impact of hyper-digital living on social and mental health, but what are the economic implications for this generation?

- As the global economy continues to struggle and interest rates and inflation drive up the cost of living and education, Gen Z faces the toughest financial outlook in a century.

- According to a survey of UAE nationals and expatriates, across different generations (Gen Z, Millennials, Gen X and above), 57% of the respondents have set specific financial goals, and a substantial 63% of the participants are inclined towards seeking professional financial advice, further boosting the demand for financial wellness across the generations.

- Moreover, in the US, Gen Z is the most stressed about personal finances at 76%, followed by millennials (72%) and Gen X (72%), then boomers (59%).

- In the context of Gen Z, banks know that this demographic has the most demanding service expectations and is the most likely to switch services if they don’t get what they expect. So, taking a strategic approach to financial wellness is not only morally sound, but also smart from a marketing and business development perspective.

- Banks must be able to quickly identify and deploy tools that proactively advance their customers’ financial well-being. Opportunities exist in personalizing the customer journey, providing budgeting and product matching tools, and monitoring for early signs of distress.

Can financial wellness be profitable for banks?

The marketplace for consumer banking grows more competitive each year. Financial wellness is highly desired by consumers and can differentiate a bank from the competition. FinTechs are taking a stab at this strategy by designing their solutions to address needs such as saving or building credit, and providing omnichannel software for banking, among others. Furthermore, banks are benefiting from increased customer retention and loyalty; as the cost to retain customers is much lower than the cost to acquire new ones.

Wrapping Up

The future of banking is centered around financial wellness and omnichannel digital banking. Consumers are seeking proactive, personalized solutions that help them achieve their financial goals, and financial institutions that deliver on this promise will build lasting loyalty.

In consumers’ eyes there’s no such thing as a channel, which is why banks must develop truly omnichannel capabilities. Integrated customer profiles, customer data platforms and customer-centric thinking hold the key to delighting customers with frictionless interactions and experiences.

There’s room for improvement and an opportunity for banks to enable their customers to handle the ups and downs of their personal finances with liquidity, insurance, responsible use of credit, and other aspects. As a result, in the US and MENA regions; financial education will empower individuals to make informed financial decisions, resulting in improved customer financial health and the potential for new cross-selling opportunities for banks.

MobiFin offers comprehensive omnichannel banking solutions that address varied needs of banking and financial institutions. Experience it for yourself – schedule a demo today.

Contact us now to explore how MobiFin’s omnichannel banking can drive inclusion and growth for you.