Loan Origination and Management System (LOMS) is a unified software solution designed for digital lending management, simplifying the entire lending lifecycle for all types of loans. Loan management system software transforms traditional methods with innovative technologies at every stage: loan inquiry and lead management to credit analysis, sanctioning, disbursement, servicing, and closure. It brings efficiency, security, and convenience for lenders and borrowers alike.

Difference between loan origination system (LOS) and loan management system (LMS)

Yes, there is a significant difference between LOS vs LMS lending software in digital loan services. Here’s the explanation:

What is LOS solution in digital lending services

The loan origination system (LOS) is software in digital loan services for lending financial institutions to optimize the three key loan processes from the initial stage: loan inquiry and lead management, credit analysis and decisions, and sanctioning.

What is LMS solution in digital lending services

The loan management system (LMS) is software in digital loan services for lending financial institutions to manage the three major loan processes to the final stage: loan account disbursement, loan servicing, and closure.

LOS + LMS = LOMS A unified loan management software

From fragmented processes to a seamless journey, digital lending management is entering a new era of speed, security, and efficiency. Fintech firms offer a loan origination system (LOS) and loan management system (LMS) as a combined solution, known as a loan origination and management system (LOMS). LOMS focuses on safety and security, while streamlining various lending processes and steps.

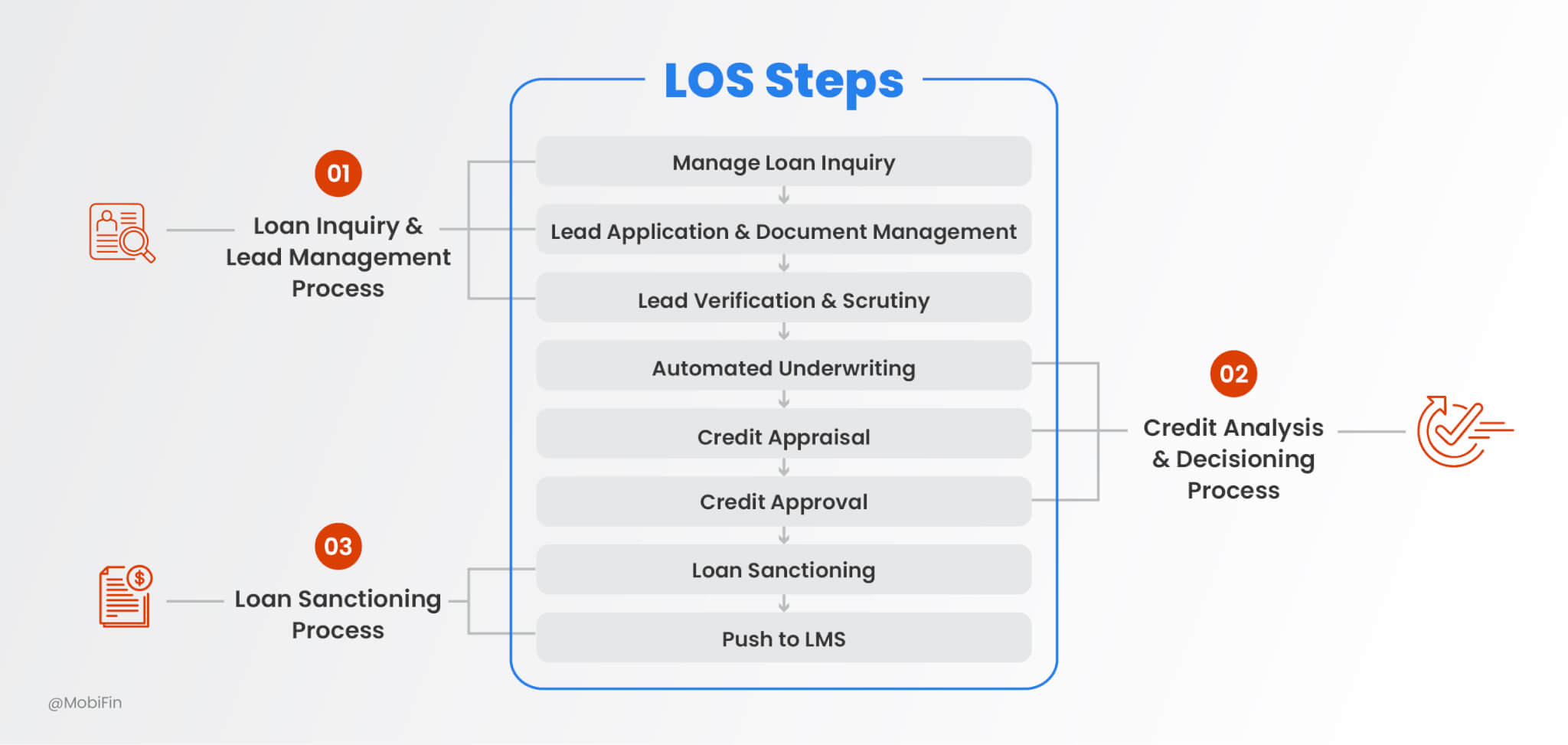

Steps in loan origination system (LOS) process

An agile LOS software streamlines three key processes across eight steps, ensuring seamless service integration for the digital lending management system. With designated personnel managing tasks, corrections, and rejections at critical stages, it enhances control and decision-making. Advanced features like e-signatures and precise reporting further strengthen compliance and operational efficiency. A well-structured LOS isn’t just a system, it’s a strategic asset for digital lending success.

- Manage loan inquiry: Whether it is a retail or corporate loan, inquiries begin with gathering basic information through channels like online platforms, agents, and branches. Fintech companies build mobile apps and web portals specifically to manage customer inquiries with AI/ML-powered chatbots and virtual assistants. An advanced LOS solution streamlines all channels and collects unique records in the system, preventing duplication and fraud.

- Lead application and documents management: When a qualified inquiry turns into a lead, LOS enables uploading personal documents and collaterals with OCR. The system auto-fills the application form with extracted data, simplifying the process. Users can review, edit editable fields, enter missing details manually, and complete the application with face match, liveness check, deepfake, and digital signature to avoid scams and fraud.

- Lead verification and scrutiny: All the lead’s details are transferred to the assigned person for document and collateral verification, corrections, or requests for additional documents and details if required. A secure solution automates the verification of AML/CFT, document authentication, and lead’s credit score/rating to assess risk at this level.

- Automated underwriting: LOS eliminates time-consuming and biased manual underwriting. It ensures AI/ML-driven automated underwriting by predefined eligibility and ratios based on loan types to immediately assess – repayment capacity, risk compliance, legal checks, creditworthiness, and determine eligible interest rates, loan tenure, and amounts.

- Credit appraisal: Scalable LOS software offers efficient credit appraisal for digital lending services with comprehensive documentation and evaluation. This enables precise tracking, along with a flexible workflow tailored to align with each financial institution’s internal policies and regulations.

- Credit approval: An authorized person efficiently conducts credit assessments, accessing all the details of leads and loans to accelerate the approval process. A flexible LOS application offers multiple approval methods (automated or non-automated) based on loan types and lender’s preference.

- Loan sanctioning: The loan sanctioning information gets completed, including the terms and conditions for sanction letters, agreement letters, negotiation notes, or any other relevant letters. LOS also ensures all details are clear, accurate, and aligned with compliance.

- Push to LMS: Borrower can track the loan status on the mobile app and web portal. When both parties agree on loan sanctioning, valid details transfer to the loan management system (LMS) software. These include lead profiles and distinct records in the system, along with disbursement, repayment, and other details, to safeguard against frauds.

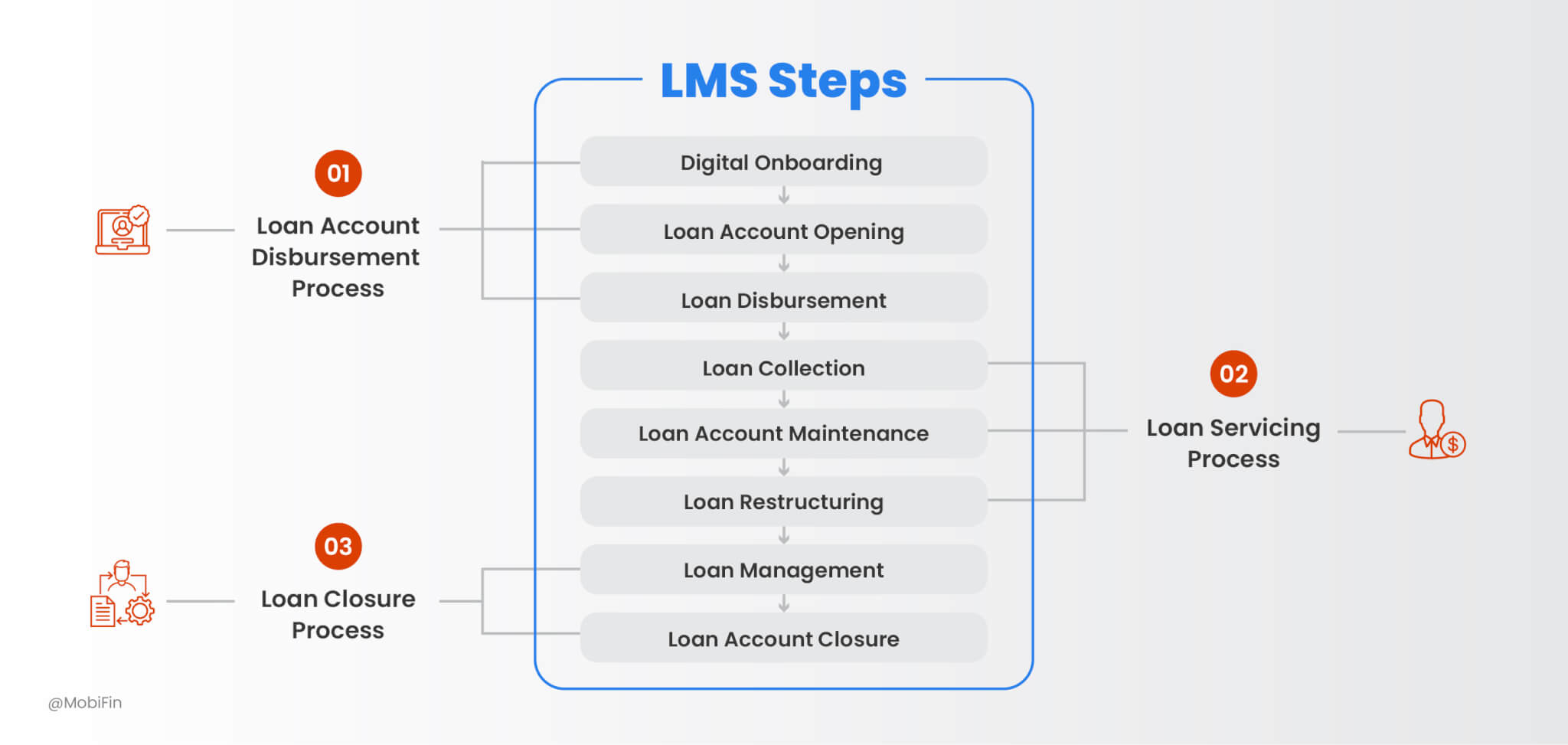

Steps in loan management system (LMS) process

A robust LMS software for digital lending integrates three major processes across eight steps, adapting to each borrower’s loan circumstances with digital onboarding, loan restructuring, and NPA management. Authorized personnel oversee distinct services, ensuring precise control at every stage. With rapid ad-hoc reporting for operations and a secure framework, an LMS system goes beyond loan management—it empowers lenders with agility, compliance, and data-driven decision-making.

- Digital onboarding: The sophisticated platform supports face match, liveness check, deepfake, and digital signature in the loan management software. It ensures that the borrower, co-borrower, and guarantor are onboarded with valid KYC details. If they have been onboarded previously, the system will detect it to manage smooth operations.

- Loan account opening: LMS opens loan accounts tailored to the borrower’s for seamless portfolio management, including loan type, required documents, collateral information, and other relevant details. This will be reflected in the customer app and web portal of the loan management software.

- Loan disbursement: Full or phase-wise loan disbursement gets initiatiated through agents or branches with alerts and notifications. Processing fees, charges, loan repayment schedules, and more get managed with ease and efficiency with predefined ratios and calculations by digital lending services.

- Loan collection: Money starts getting returned with interest by convenient methods such as online payment even via customer app or web, standing instructions, account mandates, post-dated cheques, agent/entity recovery, or even over the counter. The systematic lending management system streamlines all channels for regulatory complaint ledger management.

- Loan account maintenance: The loan account is maintained by handling interest computation, accrual, capitalization, and charge amortization. LOM provides statements, interest and balance certificates, and manages insurance submissions or other documents in line with credit unions policies and regulations.

- Loan restructuring: Trouble-free loan restructuring within the loan management system software allows credit unions to make loan refinancing, reschedule loans, and adjust repayment frequency. It leads to being able to meet specific needs immediately with predefined ratios and calculations.

- NPA management: Effective NPA management includes arrears monitoring, rule-based NPA marking, early warning systems, loan provisioning, recovery, loan suite files, collateral earmarking, legal actions and repossession, loan write-offs, and other NPA-related activities. All of these critical processes can be tracked within the LMS platform.

- Loan account closure: Once the loan account is opened, it must be closed smoothly in loan management software by processing loan settlement, applying commitment charges, and generating loan NOC/closure documents for secure and seamless closure.

Transform traditional lending into smart digital lending with innovative LOMS software solution

The future of lending demands agility, precision, and security. Traditional processes—slow, fragmented, and error-prone—are being replaced by unified LOMS applications that streamline lending management system with AI/ML automation and intelligent inquiry management on mobile/web.

An API-first approach is redefining loan lifecycles, ensuring seamless management for all lending types. Structured document templates in LMS solution enable financial institutions to handle official paperwork quickly. Scalable multi-product workflows, adaptive compliance, and secure digital ecosystems support co-lending, BNPL, and micro-lending. With intuitive ad-hoc reporting and ledger management, lenders can operate with greater efficiency, accuracy, and confidence.

The future of lending isn’t just digital, it’s intelligent, agile, and secure. Embracing a unified LOMS system with AI-driven automation, structured templates, and seamless workflows ensures efficiency at every step. It’s time to move beyond traditional processes and build a smarter, future-ready lending ecosystem.

Connect with us to know how we can raise your business potential via digital lending powered by MobiFin’s innovative LOMS technology.