Case Studies

Transform your digital banking operations into a comprehensive banking experience

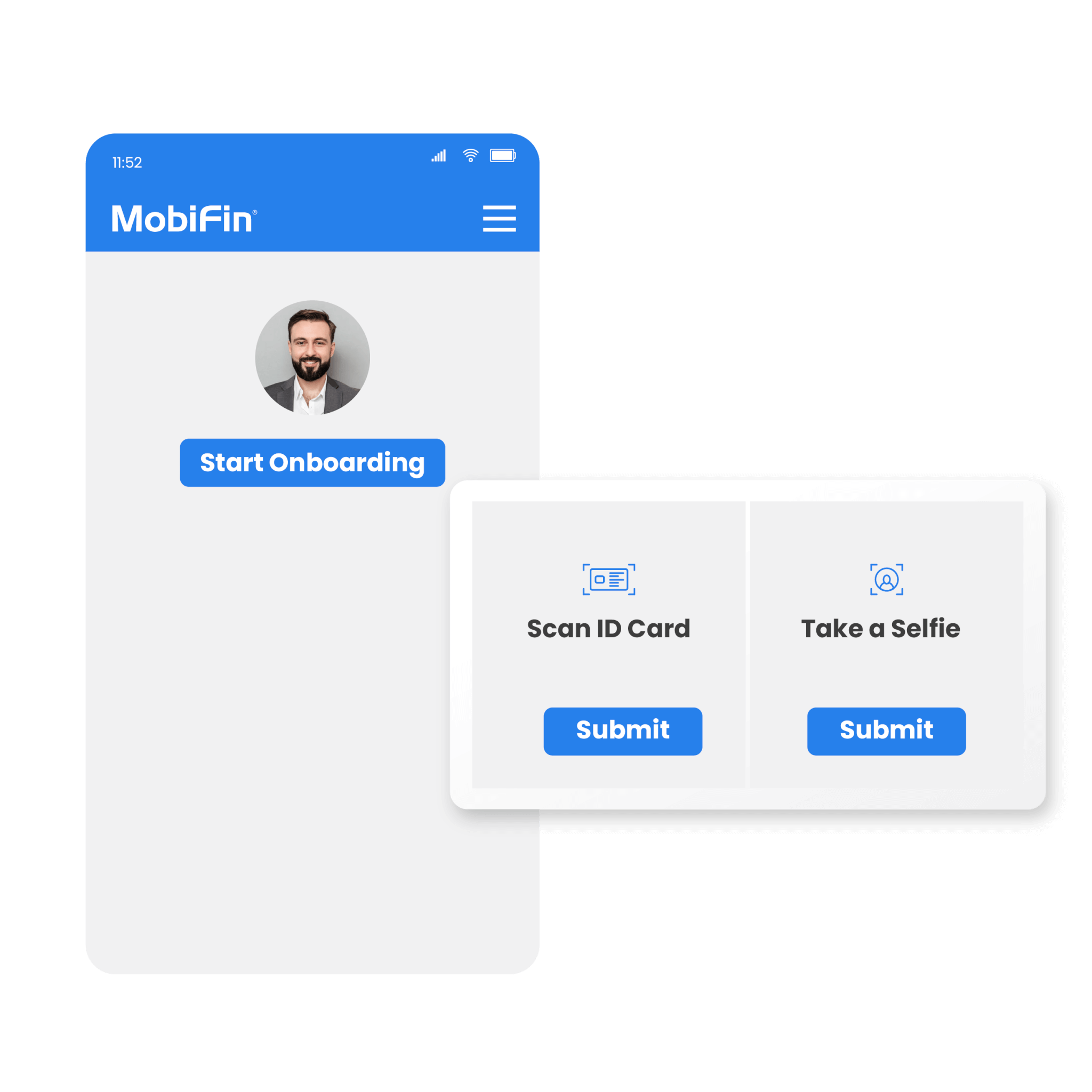

Seamless Digital Onboarding

Effortlessly onboard customers into the banking system with eKYC, OCR scan, document scan, liveliness checks, video KYC, blocklist checks, fraud prevention, and AML compliance. Customers can start using banking services without visiting a branch, making their entry into the financial journey smooth and convenient.

Unified Customer Profile

Get a holistic view of the customer's relationship with the bank. A unified customer profile keeps a comprehensive record that captures all interactions, transactions, and engagements a customer has across various channels and touchpoints. This profile consolidates data from online banking, mobile apps, in-person visits, and any other financial engagement based on customer consent.

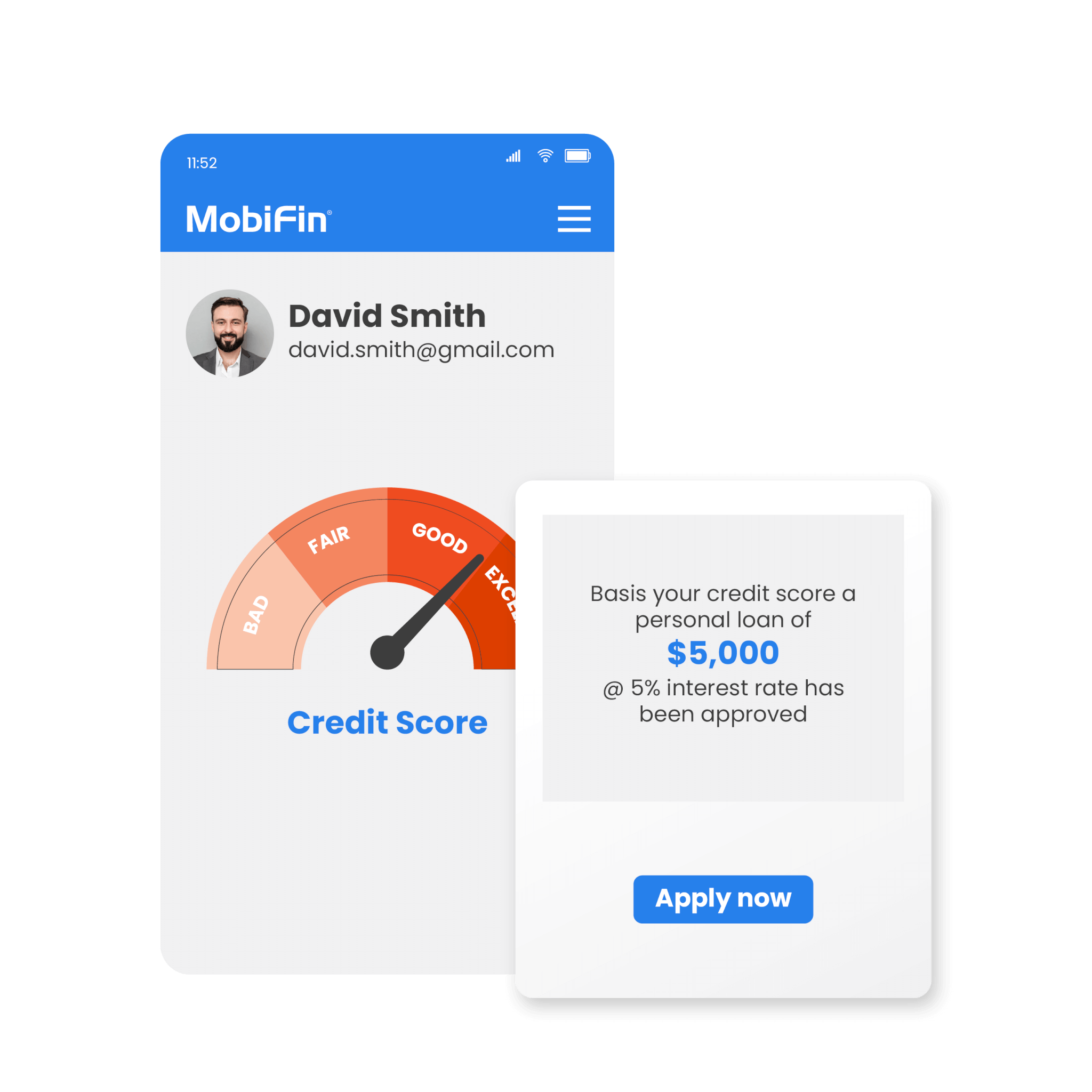

Hyper-personalized & Intelligent

Imagine a banking experience just tailored for you. Our digital banking platform leverages advanced data analysis and AI to create highly tailored experiences for each customer category. It means the platform understands individual preferences, behaviors, and needs, allowing it to offer personalized recommendations, offers, and content.

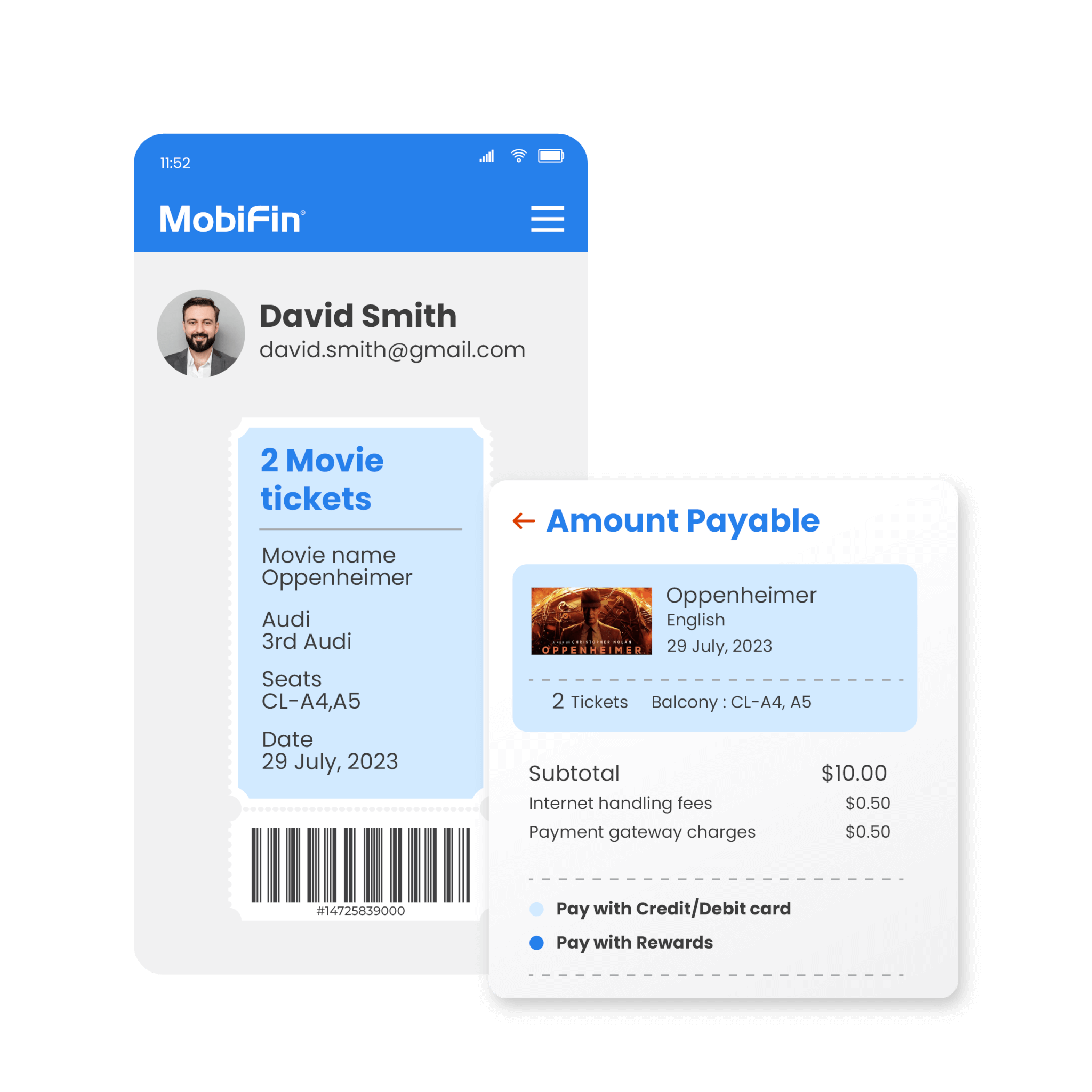

Lifestyle-centric Banking

lifestyle banking is a mix of banking and new-age FinTech offerings. The platform offers banking products and services that align with the customer's habits, preferences, and financial goals. Example: A bank can offer a "travel enthusiast" customer travel rewards, no foreign transaction fee, travel insurance, airport lounge access, and currency exchange services as part of their lifestyle banking offerings.

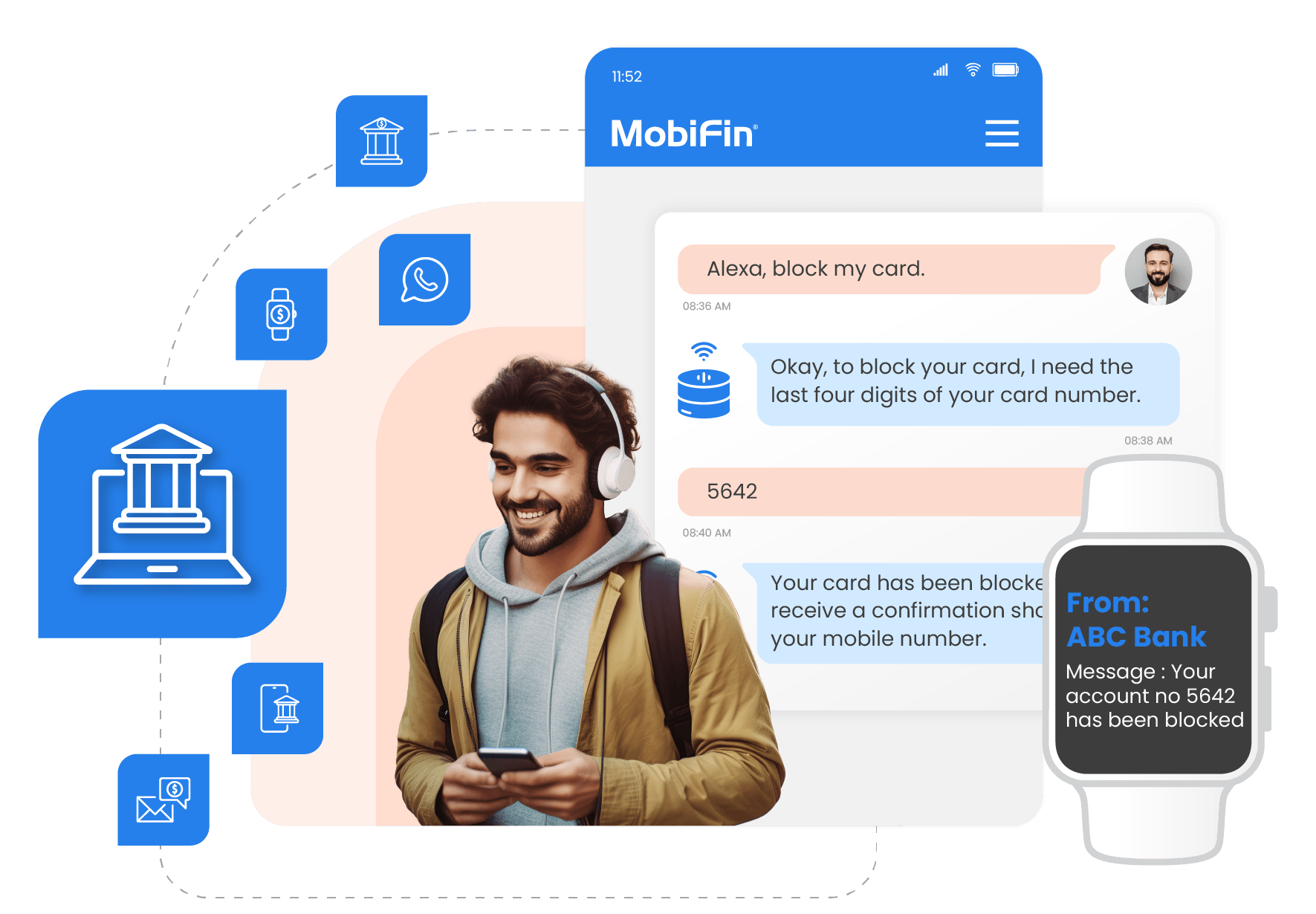

Cross-channel Consistency

Deliver a seamless and uniform experience to your customers. Regardless of the channel used such as mobile apps, websites, WhatsApp, IVRs, SMS, ATMs, wearables, chatbots, voice bots, call centers, or physical branches the user experience, branding, features, and functionality remain consistent. For example, a customer starting a transaction on a mobile app should be able to complete it on the bank's website without interruption or confusion.

Frequently asked questions

Our platform offers flexible integration options, including APIs and connectors, to ensure compatibility with your existing systems. Our experienced team can assist with the integration process every step of the way.

We support a wide range of customer channels, including mobile banking, internet banking, USSD, and social media platforms like WhatsApp. We can further tailor the channels to your specific needs and target audience.

MobiFin leverages data analytics to consolidate all customer data into a unified 360-degree view. This enables the platform to offer personalized recommendations, targeted offers, and customized dashboards, based on individual customer behavior and interactions with the platform.

MobiFin is designed to integrate seamlessly with various core banking systems, including popular choices like Temenos, Finacle, Oracle FLEXcube, and more. Our core-agnostic connectors ensure seamless integration with any core system, providing flexibility and adaptability to suit your specific banking needs.

Yes, our platform can be customized to create tailored products or services to cater to specific customer segments, such as corporate, retail, and SME customers.

The implementation timeline can vary depending on the complexity of your existing systems and the scope of customization.

Yes, our platform is designed to support multiple languages and currencies, making it suitable for businesses operating in multi-national markets.

Yes, MobiFin enables a smooth hand-off experience for end customers who start their onboarding journey on one channel (such as Internet Banking) and wish to complete it on another (like Mobile Banking).

We have both on-premises and cloud deployment options, allowing you to choose the model that best suits your infrastructure and security requirements.

Yes, our platform complies with various regulatory standards, including those related to data privacy, anti-money laundering, and know-your-customer (KYC) requirements. Additionally, we provide robust disaster recovery solutions to ensure business continuity and data protection.